A farmer has warned that the new tax to be imposed on farmland could be “the final nail in the coffin” for struggling rural communities.

Under rules effective from April 2026, the first £1million of combined agricultural and business assets will remain fully exempt from Inheritance Tax (IHT).

For any assets above this threshold, IHT will apply at an effective rate of 20% due to a 50% relief on the standard tax 40% rate.

Farmers have always been able to pass on agricultural land free from official levies.

During her Autumn Budget on Wednesday, Chancellor Rachel Reeves argued that three-quarters of farms would not be affected.

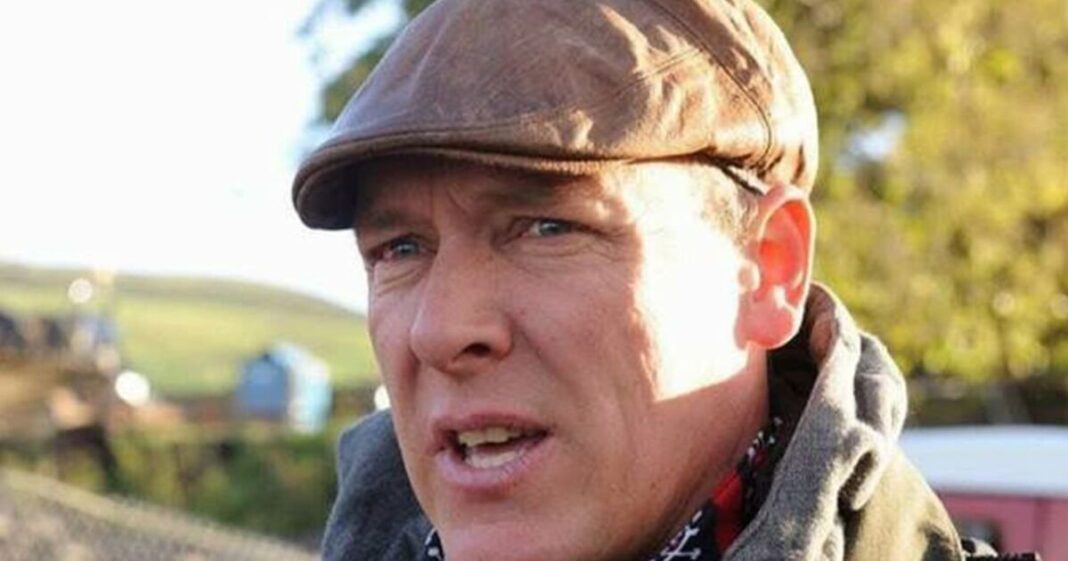

But for farmers like Gareth Wyn Jones, the shake-up only heightens the uncertainty.

Mr Jones’s farm, Tyn Llwyfan, in North Wales, has been in his family for over 370 years, with land used for sheep, cattle, and the iconic small Carneddau ponies.

The reforms present a significant challenge given most family farms easily exceed the new threshold.

Mr Jones said: “£1million might sound like a lot but it’s really not when you look at the value of land today.”

While lower than the typical 40%, the revised rate will be a formidable obstacle for farming families.

Mr Jones warned the added tax burden could be the “final nail in the coffin for a lot of us. The industry’s already struggling.”

He said: “My father and his brothers never took a holiday – they put everything they had into the land to pass it down to the next generation.

“This could affect thousands of farms. People will be wondering if it’s even worth carrying on.”

He added: “Where is the next generation of farmers coming from?”

Over the past year, the Welsh campaign group Digon yw Digon, which means ‘enough is enough’, has been organising peaceful gatherings across Wales to draw attention to the challenges faced by farmers.

They’ve been warning that tax changes on farms, along with a lack of suitable funding, could leave the country “sleep-walking into food shortages.”

Liberal Democrat MP Tim Farron said: “This is a family farm tax which risks ringing the death knell for local farmers and the small businesses who rely on them.

“Small family-owned farms will also be hit by this and will be forced to sell up, with young people robbed of their opportunity to farm.

“After years of the Conservatives taking rural communities for granted, it is deeply disappointing to see more of the same from this new Government.

“We’ll be fighting tooth and nail to protect family farms from these challenges. Liberal Democrats backed British farmers by demanding an extra £1billion to support them during the election, and we’ll keep being a strong voice for rural communities.”