Introduction: Bank of England and ECB rate decisions today

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Interest rates on both sides of the channel are likely to be left on hold today, but relief may be coming for UK borrowers within months.

Both the Bank of England (BoE) and the European Central Bank (ECB) are expected to maintain their respective interest rates unchanged today.

UK interest rates are currently 3.75%, and the rise in inflation in December to 3.4% makes it implausible that many BoE policymakers will vote to cut interest rates.

The City money markets indicate there is just a 5% chance that the BoE lowers interest rates to 3.5%, and a 95% likelihood that we get ‘no change’ at noon today.

Economists also predict seven policymakers will vote for a hold, with just two dovish members (Swati Dhingra and Alan Taylor) expected to vote for a cut.

But looking further ahead, almost two quarter-point cuts are expected by the end of this year.

Julien Lafargue, chief market strategist at Barclays Private Bank, says:

“The Bank of England is widely expected to keep interest rates unchanged in February. On the back of the Budget, we could see a more benign outlook on the inflation front, at least in the short-term.

When it comes to forward guidance, the BoE is likely to remain noncommittal about the timing of any future interest rate cuts. That said, the combination of lower inflation ahead and continued softening of the UK labour market should reinforce the central bank’s view that the path for monetary policy is towards a lower Bank rate, potentially as early as next month.”

Interest rates are already lower in the eurozone, at 2%, meaning there’s less pressure on the ECB to ease policy any further.

Eurozone inflation fell to 1.7% in January, data yesterday showed, thanks to lower energy costs and a stronger euro.

Richard Flax, chief investment officer at wealth manager Moneyfarm, says:

For investors, this environment of stable inflation and steady interest rates provides a degree of clarity and reduces the risk of further policy tightening.

We expect the ECB to remain on hold, as markets have already priced in, with a high bar for any policy action in the near term.

That said, we continue to monitor underlying price pressures and external risks, such as geopolitical developments and shifts in global demand, that could influence the outlook.”

The agenda

-

8.30am GMT: eurozone construction PMI report for January

-

9am GMT: UK car sales for January

-

9.30am GMT: UK construction PMI report for January

-

Noon: Bank of England interest rates decision

-

12.30pm GMT: BoE press conference

-

1.15pm GMT: European Central Bank interest rate decision.

-

1.45pm GMT: ECB press conference

Key events

The gap between the UK’s short-term and long-term borrowing costs has hit its widest level in around eight years, as the pressure on Keir Starmer has mounted, Bloomberg has spotted.

Bloomberg’s Alice Gledhill explains:

The yield gap between two- and 10-year gilts hit the widest since 2018 as a fresh round of UK political turbulence weighed on government bonds.

The 10-year yield rose as much as four basis points to 4.59% at Thursday’s open, pushing the gap over the two-year to 85 basis points.

UK long-term borrowing costs rise amid Mandelson crisis

UK borrowing costs are rising, slightly, this morning, as investors ponder whether Sir Keir Starmer’s premiership could be ended by the Peter Mandelson scandal.

UK bond prices are dipping, which pushes up the yield (or interest rate) on the bonds.

UK 10-year bond yields are up three basis points (0.03 percentage points) at 4.56%, while 30-year bond yield are up four basis points at 5.363% – the highest level since last November.

These are relatively small moves in bond market terms, though it’s also notable that US government bond yields have dropped slightly and German yields are flat.

Eurasia Group says Starmer is “fighting for his political life”, and now put the probability of a leadership challenge and his removal this year at 80% (up from 65% previously).

City investors may worry that a new administration might be less committed to sticking to the UK’s fiscal rules to please the bond market.

Melanie Baker, senior economist at Royal London Asset Management, expects no change from the Bank of England today:

“The BoE and ECB are widely expected – including by me – to keep rates on hold today. Many major central banks having moved closer to what they think is ‘neutral’. Against that backdrop and if economies continue to ‘tick along’, we may see more of them remain on hold for periods of time. For some, the next move will be a rate hike and the Australian central bank recently raised rates.

I don’t think that either the US Federal Reserve or Bank of England are quite done cutting rates this year, but we may have to wait a while. In the meantime, much depends on the data and there are both upside and downside risks to labour markets and inflation.”

Shell shares slip after profits drop

Shares in oil giant Shell are slipping at the start of trading in London, after it reported a 40% drop in earnings.

Shell posted adjusted earnings of $3.25bn for the last three months of 2025, down from $5.43bn in July-September. In response, its shares are down 1% at £28.37 each.

The company blamed falling income on “unfavourable tax movements”, lower energy prices and higher operating expenses.

But despite this, Shell is planing to pump more money back to its shareholders through yet another share buyback plan, worth $3.5bn.

Shell chief executive officer, Wael Sawan:

2025 was a year of accelerated momentum, with strong operational and financial performance across Shell. We generated free cash flow of $26 billion, made significant progress in focusing our portfolio and reached $5 billion of cost savings since 2022, with more to come. In Q4, despite lower earnings in a softer macro, cash delivery remained solid and today we announce a 4% increase in our dividend and $3.5 billion share buyback, making this the 17th consecutive quarter of at least $3 billion of buybacks.”

Laith Khalaf, head of investment analysis at AJ Bell, agrees it would be a surprise if the Bank of England lowered interest rates today, saying:

“It’s extremely unlikely the Bank of England is going to do anything but hold interest rates where they are at its February meeting.

The Bank reduced rates in December and has clearly indicated it wants to adjust policy gradually, so consecutive cuts are pretty much unthinkable in the current economic environment.”

The slump in bitcoin is continuing today, wiping out all the gains since Donald Trump’s election victory over a year ago.

The world’s largest crypto currency dropped as low as $70,052 early today, its lowest level since 6 November 2024, the day after the US election.

It’s now lost over 40% since hitting its last record high ($126,223) last October.

Trump has billed himself as a crypto-friendly president during his 2024 election run. But while the Trump family itself has done well out of its own cryptocurrency company, anyone who bought bitcoin since the election win is now sitting on a loss.

The pound is a little weaker against the US dollar in early trading.

Sterling’s down a third of a cent at $1.3620, its lowest level in nearly two weeks.

ING expects UK interest rate cuts in March and June

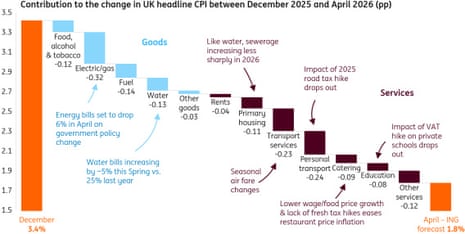

Analysts at ING have predicted that UK inflation will tumble this spring, allowing the Bank of England to lower interest rates twice by the summer.

ING estimate that headline inflation will fall to 1.8% in April from 3.4% in December – crucially, that would take the consumer prices index below the Bank’s 2% target.

They expect food inflation to slow, and for energy bills to drop in April when regulator Ofgem next sets the price cap. A smaller rise in water bills, and a slowdown in rental growth, should also ease the cost of living squeeze.

As such, James Smith, ING’s developed markets economist, expects rate cuts in March and June. That’s a more aggressive cutting cycle than the City is pricing in.

Smith says:

We forecast inflation will drop to 1.8% in April before hovering at the 2% target through the spring and summer. What’s more, we think roughly 0.8 percentage points of the decline from December’s reading is virtually locked in – an artefact of regulated price changes and tax changes.

Introduction: Bank of England and ECB rate decisions today

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Interest rates on both sides of the channel are likely to be left on hold today, but relief may be coming for UK borrowers within months.

Both the Bank of England (BoE) and the European Central Bank (ECB) are expected to maintain their respective interest rates unchanged today.

UK interest rates are currently 3.75%, and the rise in inflation in December to 3.4% makes it implausible that many BoE policymakers will vote to cut interest rates.

The City money markets indicate there is just a 5% chance that the BoE lowers interest rates to 3.5%, and a 95% likelihood that we get ‘no change’ at noon today.

Economists also predict seven policymakers will vote for a hold, with just two dovish members (Swati Dhingra and Alan Taylor) expected to vote for a cut.

But looking further ahead, almost two quarter-point cuts are expected by the end of this year.

Julien Lafargue, chief market strategist at Barclays Private Bank, says:

“The Bank of England is widely expected to keep interest rates unchanged in February. On the back of the Budget, we could see a more benign outlook on the inflation front, at least in the short-term.

When it comes to forward guidance, the BoE is likely to remain noncommittal about the timing of any future interest rate cuts. That said, the combination of lower inflation ahead and continued softening of the UK labour market should reinforce the central bank’s view that the path for monetary policy is towards a lower Bank rate, potentially as early as next month.”

Interest rates are already lower in the eurozone, at 2%, meaning there’s less pressure on the ECB to ease policy any further.

Eurozone inflation fell to 1.7% in January, data yesterday showed, thanks to lower energy costs and a stronger euro.

Richard Flax, chief investment officer at wealth manager Moneyfarm, says:

For investors, this environment of stable inflation and steady interest rates provides a degree of clarity and reduces the risk of further policy tightening.

We expect the ECB to remain on hold, as markets have already priced in, with a high bar for any policy action in the near term.

That said, we continue to monitor underlying price pressures and external risks, such as geopolitical developments and shifts in global demand, that could influence the outlook.”

The agenda

-

8.30am GMT: eurozone construction PMI report for January

-

9am GMT: UK car sales for January

-

9.30am GMT: UK construction PMI report for January

-

Noon: Bank of England interest rates decision

-

12.30pm GMT: BoE press conference

-

1.15pm GMT: European Central Bank interest rate decision.

-

1.45pm GMT: ECB press conference