UK ‘ended 2025 firmly in the slow lane’ – what the experts say

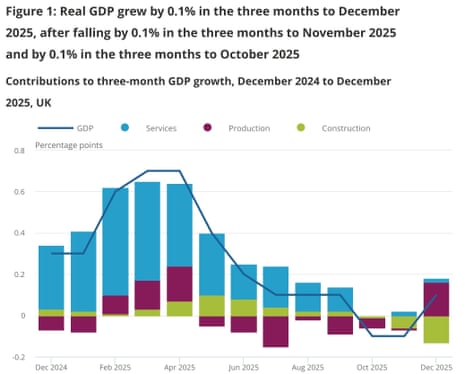

Reaction to the news that the UK grew by just 0.1% in the final quarter of 2025 (see earlier post) is rolling in, and City experts aren’t impressed.

Lindsay James, investment strategist at wealth managers Quilter, warns that the picture is ‘rather bleak at the moment’.

“A long list of data revisions from the ONS has revealed the UK economy barely kept its head above water in the final quarter of last year, with GDP growth coming in at just 0.1% after downward revisions to the previous two data prints. December saw a meagre uplift of 0.1%, which was in line with expectations, but November’s growth has been revised down to 0.2% from the 0.3% first reported.

“The Christmas period was weak by historical standards, and that is laid bare in today’s data. The services sector, which had previously been noted as the largest contributor, showed no growth and its impact was revised down from 0.2% to nothing in the three months to November too. Surprisingly, production output grew by 1.2%, having fallen by 0.1% in the three months to November, but it was outweighed by a fall of 2.1% in the construction sector which followed a 0.9% fall previously.

Scott Gardner, investment strategist at JP Morgan Personal Investing says the economy failed to hold onto the stronger growth seen in early 2025:

“The UK economy ended 2025 firmly in the slow lane, undershooting expectations and remaining in a low gear in the final quarter of the year as businesses and consumers digested the Chancellor’s November Budget. This marks a clear reversal in fortunes for the economy after strong growth shown in the first half of the year failed to carry over into the rest of 2025.

“Many will be hoping that the slow pace of economic expansion in the final quarter is only temporary after the Jaguar Land Rover shutdown stunted growth in the Autumn and led to a sharp fall in productivity. Services performed well over December, but construction and industrial production activity declined. Consumer spending showed more promising signs and has bounced back as real wage growth has fed through into higher retail and online spending.

The Unite union are calling for more investment to lift growth; their general secretary Sharon Graham says:

“Today’s figures are further proof that the UK economy will not get the growth we were promised until we reverse our historic levels of underinvestment.

“The figures also show that real household disposable income fell in 2025. Families up and down the country are getting poorer in real terms.

“We need to stop the rot and start delivering for everyday people.”

Key events

Today’s GDP report is not great news in the fight against inflation, reports Professor Costas Milas, of the University of Liverpool Management School:

At face value, today’s GDP reading looks “good” on the inflation front. According to my own estimates, output gap (that is, output relative to “trend” output) is estimated at -1 per cent ended up at 2025Q4, down from -0.8 per cent in 2025Q4. This is in line with the BoE’s latest Monetary Policy Report and should drag CPI inflation down. The problem, however, is that the negative output gap contributes very little to inflation developments.

As I show in my latest LSE Business Review blog the recorded negative output gap is less important for CPI inflation than the persistence of inflation or public inflation expectations, the latter remain elevated and close to 3 per cent. A quick drop in inflation is far from certain.

Starmer: The economy is growing

Prime minister Keir Starmer has claimed that the (modestly) growing economy means people have ‘more money’ in their pockets.

Posting on X, he says:

Job number one is easing the cost of living pressure that many people still feel.

Today’s GDP figures show our economy is growing. That means more money back in your pocket.

I know there’s more to do, but we are heading in the right direction.

Job number one is easing the cost of living pressure that many people still feel.

Today’s GDP figures show our economy is growing. That means more money back in your pocket.

I know there’s more to do, but we are heading in the right direction.

— Keir Starmer (@Keir_Starmer) February 12, 2026

However (as flagged earlier) GDP per head actually shrank by 0.1% in October-December, meaning that the population grew faster than the economy in the final quarter of the year.

As GDP per head is a key measure of living standards, this suggests people became slightly less prosperous in the final three months of last year.

FTSE 100 hits record high over 10,500 points

Despite the UK’s weak growth, the London stock market has hit another record high this morning.

The FTSE 100 share index rose over the 10,500 point mark in early trading to hit a fresh intraday high of 10,535 points, up 63 points or 0.6%.

It was lifted by Schroders, the UK asset management firm, which has accepted a £9.9bn takeover over from US investor Nuveen. This pushed Schroders’ shares up by almost 30% this morning.

The UK economy may pick up, slightly, in the first half of this year, economists suggests.

Andrew Hunter, associate director and senior economist at Moody’s Analytics, says:

“The fourth-quarter GDP data confirm that the U.K. economy ended 2025 on a subdued note with GDP expanding by just 0.1%, in line with the third quarter’s reading.

Household and government consumption grow modestly, but this was offset by a contraction in fixed investment and a slump in exports. The survey evidence has improved in recent months and we expect the pace of growth to pick up slightly over the first half of 2026, benefiting from further monetary easing and stronger growth in European trading partners.

But persistent global headwinds and fiscal consolidation will prevent a more meaningful acceleration.”

Budget uncertainty blamed for weak growth

Experts are blaming budget uncertainty for the UK’s weak end to 2025.

Danni Hewson, head of financial analysis at AJ Bell, says:

“Subdued, sluggish, and slow – three words that sum up UK economic growth during the last three months of 2025 and in the year as a whole.

“Whilst the chancellor can celebrate the fact the UK enjoyed the fastest growth of any European G7 country last year and that growth was a smidgeon higher than in 2024, she does have to bear responsibility for the choices made and the timing of her last Budget. The service sector, which is often the powerhouse of the UK economy, has struggled to deal with reduced confidence which was exacerbated by the months of speculation and pitch rolling ahead of last year’s unusually late Budget.

Adam Hoyes, senior asset allocation analyst at wealth manager Rathbones, is concerned by the 2.7% quarterly decline in business investment in Q4 2025:

Uncertainty ahead of the Budget at the end of November probably played a role here, but it still underscores what we see as the structural cause of the UK’s poor growth rate in recent years – persistently low rates of investment. Any further uncertainty created by a potential change of occupants at Number 10 and 11 is unlikely to improve that situation in the short term.

BoE deputy governor: reasonable to expect rate cut over next couple of meetings

A Bank of England deputy governor has predicted that UK interest rates will be cut again soon.

On a visit to Manchester, Sarah Breeden told the Business Live website (no relation) that a rate cut could come in the next couple of meetings.

She said:

“If we continue to have the economy develop as we expected and if there are no shocks – to be clear those are two big ifs… I think it’s reasonable to expect there to be a cut over the next couple of meetings.”

Breeden is one of the four members of the Bank’s Monetary Policy Committee who voted to cut rates last week, but were outvoted by the other five.

Bank of England could cut rates in March to spur growth

Britain’s weak growth will put more pressure on the Bank of England to lower interest rates.

The Bank held borrowing costs unchanged last week, but the money markets narrowly expect a cut in March.

Luke Bartholomew, deputy chief economist at Abderdeen, says:

“The UK economy managed to eke out some very modest growth at the back end of last year. On a purely national accounting basis, the economy started 2026 with very little momentum. But looking at various surveys, there were some tentative signs that sentiment turned a corner and started to improve after the budget last year, which could help deliver a pick-up in activity this year.

However, recent political uncertainty may see that sentiment bounce reverse. And it is still hard to see what will drive a sustained increase in the underlying rate of growth this year.

All of which means that the Bank of England is set to continue to lower interest rates to try to support growth, and we expect the next cut at the March meeting.”

TUC general secretary Paul Nowak is calling for ‘quickfire’ rate cuts:

“It’s welcome that the economy kept growing in December, and last year’s growth of 1.3% was the strongest for three years.

“But many workers are not yet feeling the benefit in their pockets. Household incomes are still being squeezed by a relentless cost-of-living crisis.

“Many working families don’t have any money left over to spend on the things that keep our economy moving – meals out, shopping on the high street, and family days out. That’s bad for families and bad for the wider economy.

“This doom loop must end. Ministers must stay laser-focused on cutting working people’s household costs and improving living standards this year.

“And the Bank of England must go further and faster with quickfire interest-rate cuts in the months ahead.

Britain’s economy ended 2025 on “a lacklustre note”, says James Smith, developed markets economist at ING, with growth of just 0.1% in the final quarter.

Smith adds:

What’s particularly eye-catching from the release is just how weak business investment (-2.7%) and construction (-2.1%) came in during the final few months of the year.

The former will have been heavily influenced by volatile car production, linked to a major cyberattack at the tail-end of the third quarter, even if it’s tempting to blame it on the wider uncertainty in the run-up to the Budget and the weakness in business confidence.

New housebuilding slumped in Q4

However, today’s GDP report also shows the government is struggling to hit another target – to boost housebuilding.

Private housing new work fell by 3.6% in October-December, which helped to drag output in the wider construction sector down by 2.1% in the quarter.

Budget concerns stalled construction output by an estimated 2.1% across 7 of the 9 sectors in Q4 2025. New work and repair and maintenance both fell by 2.6% and 1.5%, respectively but it was new housing, which fell the hardest down by 3.6%. Overall development confidence remained… pic.twitter.com/PVHl0S7Kz4

— Emma Fildes (@emmafildes) February 12, 2026

UK ‘fastest growing G7 economy in Europe’ in 2025

Today’s GDP report gives us a chance to compare the UK’s economic performance in 2025 against its major rivals.

Keir Starmer promised to deliver the fastest growing economy in the G7 – and today the government can boast that the UK outpaced the largest economies in Europe.

UK GDP is estimated to have increased by 1.3% annually in 2025, the ONS reported this morning (see earlier post), stronger than in 2024 but still pedestrian compared to long-term trend growth rates.

That beats France, which reported 0.9% growth in 2025, Italy, where the economy grew by 0.7% from the year earlier, and Germany, where gross domestic product rose by just 0.2% in 2025. “Weak, weak, weak”, as Tony Blair once put it.

However, we can’t do a full G7 league table yet as we don’t have Q4 GDP data from Japan, the US or Canada.

Canada’s GDP is officially estimated to have risen by 1.3% in 2025, which would match the UK, while the US is expected to grow more quickly than that.

Chancellor of the Exchequer Rachel Reeves points out that the UK is the fastest growing G7 economy in Europe, saying:

“Thanks to the choices we have made, we’ve seen six interest rate cuts since the election, inflation falling faster than predicted and ours is the fastest growing G7 economy in Europe.

The Government has the right economic plan to build a stronger and more secure economy, cutting the cost of living, cutting the national debt and creating the conditions for growth and investment in every part of the country.”