Bank: CPI inflation is judged to have peaked

Newsflash: The Bank of England believes the recent rise in UK inflation is over.

Announcing today’s decision to leave interest rates on hold, the Bank declares “CPI inflation is judged to have peaked.”

UK inflation has been recorded at 3.8% in July, August and September – and the Bank is expressing confidence that the process of ‘disinflation’ isn’t over.

Its latest Monetary Policy Report, just released, predicts that inflation is likely to fall to close to 3% early next year before gradually returning towards to the 2% target over the subsequent year.

It says:

Progress on underlying disinflation continues, supported by the still restrictive stance of monetary policy. This is reflected in an easing of pay growth and services price inflation. Underlying disinflation is being underpinned by subdued economic growth and building slack in the labour market.

The Bank had previously forecast that inflation would peak at 4% in September.

Key events

Bank predicts growth will pick up in Q4

Bank of England economists predict UK growth will pick up in the final quarter of this year.

They warn that underlying GDP growth remains subdued, but expect it to pick up slightly in the near term.

The Bank estimates that the economy grew by 0.2% in July-September, less than it had previously forecast, which it attributes to “weaker-than-expected growth in exports to the US, as well as disruption linked to the Jaguar Land Rover cyberattack”.

Headline GDP growth is expected to pick up to 0.3% in Q4.

Bank: CPI inflation is judged to have peaked

Newsflash: The Bank of England believes the recent rise in UK inflation is over.

Announcing today’s decision to leave interest rates on hold, the Bank declares “CPI inflation is judged to have peaked.”

UK inflation has been recorded at 3.8% in July, August and September – and the Bank is expressing confidence that the process of ‘disinflation’ isn’t over.

Its latest Monetary Policy Report, just released, predicts that inflation is likely to fall to close to 3% early next year before gradually returning towards to the 2% target over the subsequent year.

It says:

Progress on underlying disinflation continues, supported by the still restrictive stance of monetary policy. This is reflected in an easing of pay growth and services price inflation. Underlying disinflation is being underpinned by subdued economic growth and building slack in the labour market.

The Bank had previously forecast that inflation would peak at 4% in September.

Dhingra and Taylor fear interest rates are ‘significantly’ too high

Some Bank of England policymakers are concerned that interest rates are “significantly” too high.

Four MPC members – Sarah Breeden, Swati Dhingra, Dave Ramsden and Alan Taylor – voted for a quarter-point cut in interest rates today, but were narrowly outvoted when governor Andrew Bailey joined the other side.

The Bank says:

These members attached a greater weight to downside risks, given that these would reflect a continuation of current trends, with particular concerns that household saving would remain elevated and weigh on consumption.

For two members in this group (Swati Dhingra and Alan Taylor), policy was already significantly over-restrictive, which could unduly damage activity and possibly lead to an undershoot in inflation in the medium term.

Bank split 5-4 on rate cut – governor in the majority

Bank of England governor Andrew Bailey had the decisive vote at this week’s interest rate decision.

The minutes of this week’s meeting show that five of the nine members of the Bank’s monetary policy committee voted to hold rates at 4%, while the other four wanted a cut to 3.75%.

The bank says:

Four members in this group (Megan Greene, Clare Lombardelli, Catherine L Mann and Huw Pill) placed greater weight on risks of persistence in inflation, requiring more prolonged monetary policy restriction. While there had been some progress in underlying disinflation, these members were concerned that this could stall, as they placed particular weight on the risk of higher inflation expectations or structural shifts leading to inflation persistence.

One member in this group (Andrew Bailey) judged that the overall risks to medium-term inflation had moved down to become more balanced recently. But there was value in waiting for further evidence.

UK INTEREST RATE DECISION

Newsflash: Bank of England policymakers have left interest rates on hold at 4% as expected, in a narrow vote.

The BoE’s nine-member monetary policy committee (MPC) has voted to maintain Bank Rate at 4%, resisting any temptation to lower borrowing costs for the sixth time since August 2024.

That’s a blow to borrowers hoping for lower interest rates, but will cheer savers.

Policymakers were split 5-4 on the decision, though, showing that the decision was close.

More to follow….

The pound is a little stronger today, as investors brace for the Bank of England’s interest rate decision in just a few minutes. It’s up a third of a cent at $1.309.

Shares are lower in London, though, with the FTSE 100 share index down 30 points at 9747 points.

Stand By Your Desks! The Bank of England is up in ten minutes.

Let us set some market markers.

FTSE 100 at 9750

US $1.3091

UK ten-year yield 4.47%— Shaun Richards (@notayesmansecon) November 6, 2025

It’s a busy morning for fines for financial failings.

The Central Bank of Ireland has fined Coinbase Europe €21,464,734 for breaching its anti-money laundering and counter terrorist financing transaction monitoring obligations.

It says Coinbase Europe failed to properly monitor more than 30 million transactions over a 12-month period, worth over €176bn.

JP Morgan has been hit with a €45m fine from Germany’s financial watchdog BaFin for shortcomings in its anti-money-laundering controls.

Nick Atkin, CEO of housing assocation Yorkshire Housing, hopes the Bank of England cuts interest rates today.

Atkin argues the BoE could help the economy by accelerating interest rate reductions, saying:

“This isn’t just about housing, it’s about growth, jobs, and confidence. A decisive rate cut would give the economy room to breathe and provide the stability the housing sector desperately needs.

“Every month rates stay high means fewer homes and fewer people with a decent, affordable place to live.

“The Bank is chasing indicators it can’t control. Inflation isn’t high because we’re spending too much, it’s being driven by external shocks and supply issues. Keeping rates high won’t fix that, but it is stifling investment and housebuilding when we need both.”

City braces for interest rate decision at noon

There’s less than an hour to go until the Bank of England announces its decision on UK interest rates, and excitement is mounting.

The fact several banks have recently predicted a cut, from 4% to 3.75%, today, while others expect no change, makes this month’s decision particularly tense.

Lawrence Kaplin, chief market strategist at Equals Money, says:

“Expectations are for the bank to leave interest rates unchanged at 4.0% but this is far from certain with markets pricing-in a 35% probability of a cut to 3.75%.

Notably, this still leaves room for further GBP weakness should the BoE cut rates and/or downgrade UK growth prospects.

Traders will be closely monitoring the vote count and new growth and inflation forecasts for clues as to the bank’s future monetary policy path.”

AJ Bell investment director Russ Mould reckons today’s decision is “hard to call…with several observers expecting a rate cut even if the market is pricing in no change”.

Mould adds:

“Recent signs of easing inflation and a softer labour market would give the Bank some cover for a cut and the downbeat tone to Chancellor Rachel Reeves’ speech this week may encourage Governor Andrew Bailey and his colleagues to act ahead of the Budget later this month.

“It all boils down to whether the Bank feels it needs to get one step ahead of any Budget-related economic setback. The central bank has form in being reactive rather than proactive, so the likely outcome still seems to be that it waits until December before making the next move.

Bad weather may also have hurt UK builders last month.

Thomas Pugh, chief economist at RSM UK and Ireland, says:

“The Construction PMI fell again in October, likely in part due to Storm Amy and Benjamin which will have dampened construction activity in October.

What’s more, uncertainty over the upcoming budget looks to be weighing on activity as firms hold off on major projects until the outlook becomes clearer. A direct read of the dismal Construction PMI translates to -1.3% growth in the three months to October for the sector, but the PMI has been far too downbeat of late.

Today’s S&P Global construction PMI points to a sector firmly in retreat, says Matt Swannell, chief economic advisor to the EY ITEM Club.

The weakness in the PMI is probably more reflective of the mood of construction businesses rather than activity, as the potential for taxes rises at the upcoming Autumn Budget and a delay in interest rate cuts have weighed on sentiment.

“Prospects for the construction sector are mixed. Government investment and planning reforms will offer some support to the sector. However, ongoing uncertainty around the domestic economy and a further increase in taxes at the Autumn Budget may cause some private sector projects to be delayed or cancelled, while labour shortages continue to reduce the viability of some new construction.”

October’s slump in construction activity is a blow to the “Build, baby build” ethic being pushed by UK housing secretary Steve Reed.

Property agent Emma Fildes points out that sluggish demand and increased costs hurt the sector:

Build, baby build…..Construction activity declines at fastest pace for over five years….S&P Global UK Construction Purchasing Managers’ Index showed activity further slipped in October due to sluggish demand and increased costs. Civil engineering and Residential development… pic.twitter.com/lypIrRQ3MH

— Emma Fildes (@emmafildes) November 6, 2025

UK construction activity falls at fastest pace for over five years

Newsflash: Activity in the UK construction sector has declined at the fastest pace for over five years.

Civil engineering and domestic housebuilding both shrank sharply in October, according to the latest survey of purchasing managers from data provider S&P Global.

Construction firms reported a sustained downturn in new work last month, which was blamed on sluggish market conditions, fewer tender opportunities and delays with the release of new projects. There were also reports that elevated political and economic uncertainty had discouraged client spending, the report says.

Building firms also cut staff at the fastest rate in just over five years, due to the shortfall in demand which also led to weaker demand for construction products.

This pulled the S&P Global UK construction PMI down to 44.1 in October, from 46.2 in September. That shows the steepest decline in industry activity since May 2020 (any reading below 50 indicates a contraction), when building work was hit by the Covid-19 lockdown.

Tim Moore, economics director at S&P Global Market Intelligence, says:

“UK construction companies reported another challenging month in October as the prolonged weakening of order books so far in 2025 resulted in the fastest decline in business activity for over five years. Civil engineering and residential activity saw the fastest rates of contraction, while commercial building showed some resilience.

Reduced workloads were again widely attributed to risk aversion and delayed decision-making among clients, which contributed to a slower-than-expected release of new projects. Subdued demand in the wake of heightened political and economic uncertainty also led to the steepest drop in input buying since May 2020.

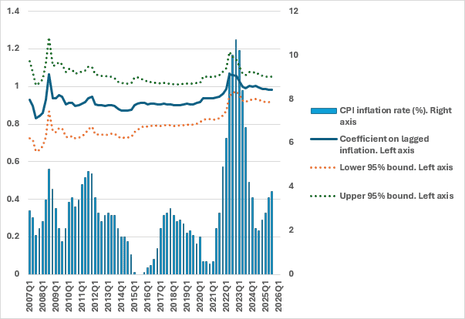

Professor Costas Milas, of the Management School at the University of Liverpool, is surprised by the speculation of a Bank of England interest rate cut today.

He tells us that it’s not a good time to lower borrowing costs:

For a start, the latest Divisia money growth data for 2025Q3 came at 3.1%, which is pretty healthy and promising for GDP growth. This will also “support”, to some extent, inflation.

More worryingly, perhaps [see chart below] I notice that inflation persistence has slightly shifted upwards over the most recent period and that higher inflation is associated in general with higher inflation persistence. (I calculate inflation persistence by modelling UK inflation using divisia money, OBR output gap effects, and the effect from Global supply pressures).

In my view, not a good time to cut Bank Rate now.

Norway leaves interest rates on hold

Over in Oslo, central bankers have voted to leave interest rates on hold.

Norway’s central bank kept its policy interest rate on hold at 4.0% on Thursday, as expected.

Norges Bank governor Ida Wolden Bache said in a statement:

“The job of tackling inflation has not been fully completed, and we are not in a hurry to reduce the policy rate.”

Norges Bank also indicated that it expects to cut interest rates over the coming year, if the economy evolves broadly as expected.

China warms on trade deals with EU

Lisa O’Carroll

China said on Thursday it is willing to explore the possibility of various trade and investment agreements with the EU.

Commerce ministry spokesperson He Yadong told a press conference that the two sides share “extensive common interests and huge space for cooperation.”

The comment followed remarks by Chinese foreign minister Wang Yi on Tuesday, who told his Estonian counterpart in Beijing that China was ready to negotiate and sign a free trade agreement with the bloc.

It comes amid urgent efforts by the EU to persuade China to ease up on restrictions on the supply of chips and rare earths, vital for car and other industries, something already achieved by Donald Trump.

Speaking in Kuwait yesterday, trade commissioner Maroš Šefčovič said the EU had established a “special channel” of communication with Chinese authorities to secure the flow of rare earth materials vital for EU industries.

He said he had discussed the issue directly with commerce Minister Wang Wentao several times, stressing that poorly managed export procedures could have a “very negative impact on production and manufacturing in the EU”.

Sainsbury’s CEO predicts budget uncertainty will delay spending

The boss of Sainsbury’s has warned that UK consumers are likely to delay purchases until after the government budget on November 26.

CEO Simon Roberts told reporters:

“I think customers will be cautious.

I think there’ll be some delayed spending until all of the news of the next few weeks comes through.”