Rumor mill: A recent rumor suggests that Samsung’s ambitious 1.4nm node, known as SF1.4, may be scrapped entirely. This speculation comes from a trusted leaker, @Jukanlosreve, casting doubt on the future of the process.

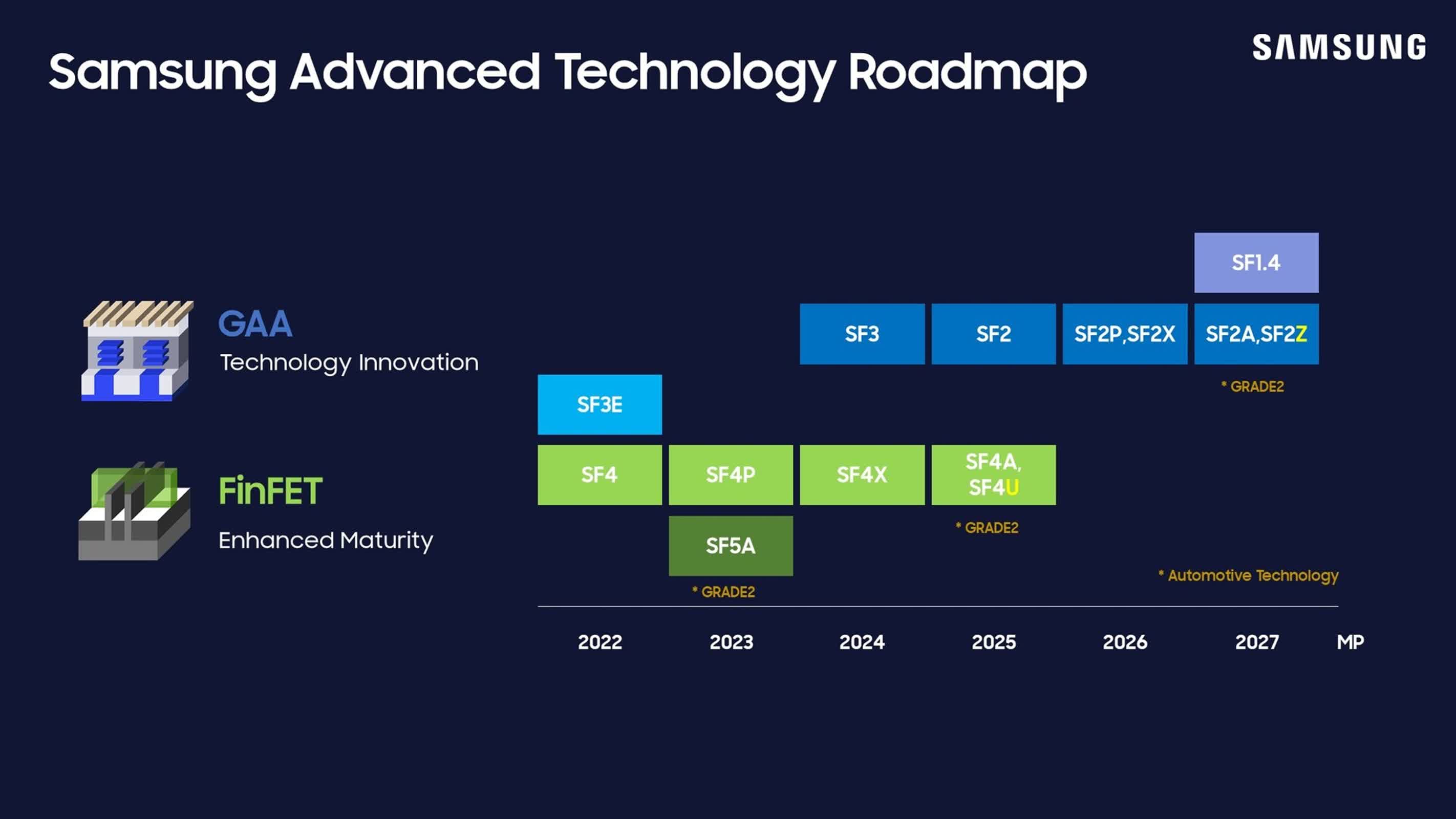

Samsung Foundry had originally planned for the SF1.4 node to enter high-volume manufacturing by 2027 alongside other specialized nodes like SF2A – designed for automotive applications – and SF2Z, the company’s first to incorporate Backside Power Delivery Network (BSPDN) technology.

Samsung’s entry into the 1.4nm class with SF1.4 would have marked a significant technological leap, promising improved power efficiency and performance over previous generations – an advancement particularly crucial for high-performance computing and AI applications. To gain a competitive edge, Samsung designed SF1.4 with a cost-effective approach aimed at reducing production costs, potentially helping it capture more market share.

Urgent: Samsung’s SF1.4 might be canceled.

Are they planning to shut down Samsung Foundry?

– Jukanlosreve (@Jukanlosreve) March 14, 2025

The potential setback is part of a broader series of challenges the company is facing.

Samsung Foundry has struggled with subpar yields from its SF3 process, resulting in a delayed launch of the Exynos 2500. Additionally, the company has had to scale back parts of its older 5nm and 7nm nodes due to low demand.

Despite these setbacks, Samsung is reportedly continuing to develop the Exynos 2600 on its SF2 process and is working on AI chips for PFN. Furthermore, some of its 4nm nodes have received fresh orders from Chinese fabless companies affected by sanctions, according to Chosun.

However, major industry players continue to favor competitors like TSMC and Intel over Samsung. The Korea Economic Daily notes that Samsung Foundry’s market share of 8.2 percent pales in comparison to TSMC’s dominant 67.1 percent, which could lead to a significant overhaul within the company. Furthermore, Business Post suggests that the Exynos department may be transferred to Samsung MX, giving it more control over future smartphone system-on-chip designs.

Samsung’s struggles in the semiconductor sector are compounded by broader challenges across its business divisions. The company recently reported a decline in market share across several key sectors, including smartphones and memory chips. Samsung’s Mobile Division saw its market share drop to 28.3 percent in 2024, down from 30.1 percent in 2023, while its DRAM market share slipped to 41.5 percent from 42.2 percent.

The company is also facing geopolitical risks and raw material price volatility, which further complicate its operations.

In response to these challenges, Samsung is slashing its foundry investments for 2025 by more than half, reducing them to KRW 5 trillion ($3.5 billion), compared to KRW 10 trillion in 2024.