Introduction: First annual drop in UK houses asking prices since January 2024

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The UK housing market appears to be cooling, driven by London and the south of England.

New figures from property portal Rightmove this morning show that the average asking price on a UK home is 0.1% lower than this time last year, following several months of muted price growth.

That’s the first annual decline in asking prices since January 2024, which Rightmove attribute to several months of “competitive pricing” by new sellers over the summer, as some cut prices to secure a buyer.

The decline in asking prices is mainly seen in the south of the country; they’re down 1.1% in London, -0.7% in South East England, and -1.3% in the South West.

In contrast, asking prices are still 2.6% higher than a year ago in Scotland, and 3.2% higher in the North West of England.

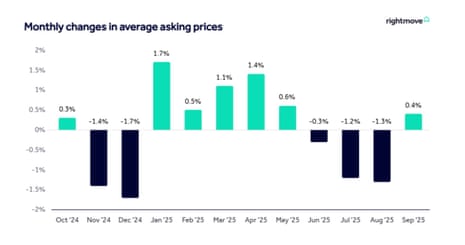

On a month-on-month basis, though, Rightmove reports that the average asking price rose by 0.4% (+£1,517) to £370,257.

Colleen Babcock, property expert at Rightmove, explains:

“We’d expect to see a slight uptick in new seller asking prices in September, with the traditional back to school season boosting activity heading into autumn. This year’s 0.4% September price rise is a little lower than the norm, which is an average of 0.6% at this time of year.

However, prices have now dipped slightly from where they were at this time last year after a summer of competitive pricing by sellers, and it’s the south of England which is driving this small dip. It’s the sensible and attractive seller pricing we’ve been reporting which has been helping to drive more sales activity compared to last year. Static house prices, rising wages, and lower mortgage rates all assist buyer affordability, which has led to an increase in the number of sales agreed compared to a year ago.”

The agenda

-

10am BST: Eurozone trade balance for July

-

Noon: Bank of International Settlements’ Quarterly Review of financial markets

-

1.30pm BST: US Empire State Manufacturing Index

Key events

China’s economy slows in August

China’s economy stumbled over the summer, new data shows, increasing pressure on Beijing to stimulate its economy.

China’s factory output and retail sales both rose at the weakest rate this year in August.

Retail sales rose 3.4% in August from a year earlier, down from 3.7% in July, while industrial output growth slowed to 5.2% in August, down from 5.7% the previous month.

Year-to-date fixed-asset investment saw a significant slowdown, growing by just +0.5% compared to +1.6% in January-July.

Jim Reid of Deutsche Bank reports that this “weak monthly data dump from China” is encouraging hopes of further policy stimulus, with China’s CSI300 share index up 0.2% today and South Korea’s KOSPI rising 0.4%.

As well as warning about food inflation pressures, German discount chain Aldi has also said it will invest £1.6bn over the next two years in the UK.

This will include opening 80 more stores – part of Aldi’s plan to eventually operate 1,500 stores across the UK, up from 1,060 at present.

A total of 21 stores are set to open in the next 13 weeks, including Shoreditch in London, Durham in the North East, and Kirkintilloch in Scotland, Aldi reports.

Aldi’s latest financial results, released this morning, show that sales rose to £18.1bn in 2024, up from £17.9bn in 2023. But it also reports that operating profit fell to £435.5m from £552.9m the previous year, a profit margin of 2.4%.

Food inflation tipped to accelerate, as Aldi warns budget could push prices higher

Fears are growing that UK food inflation is accelerating, hurting households across the country and making it harder for the Bank of England to lower interest rates.

The Food and Drink Federation (FDF), an industry body, has upgraded its food and non-alcoholic drink inflation forecast, projecting that it could reach 5.7% by December. This is up from its previous forecast of 4.8%.

The FDF says food manufacturers suffer the financial burden of government policies, such as changes to employer National Insurance Contributions, and the new packaging tax, Extended Producer Responsibility (EPR).

Dr Liliana Danila, lead economist at The Food and Drink Federation, explains:

“Food and drink inflation has been climbing steadily all year, with no sign of easing. Looking at the longer-term picture, today’s prices are steeper than anything in recent decades. The five-year average is running at more than double the rate seen between 1990-2010.

“Inflationary spikes between 2020 and 2023 were driven by geopolitical shocks which created supply chain disruptions and sharp rises in energy and raw ingredients. With most of these costs now stabilised, this new inflation surge is fuelled by the financial impact of domestic policies, now trickling down to supermarket shelves.”

Separately, the boss of Aldi has warned that any measures in the Budget that further increase costs on employers could lead to higher food prices.

Giles Hurley, chief executive of Aldi UK, told the BBC that the National Insurance rise and new packaging rules had already “rippled through to prices on the shelf edge” across the supermarket sector.

He added:

“Any policies which affect the operating costs of business should be considered very, very carefully because of the very real risk they find their way… back into the food system and onto prices.”

Here’s a map from Rightmove showing the state of play in the UK housing market:

The cost of renting a property in Great Britain has also dipped this summer.

Estate agent Hamptons reports that newly agreed rents in Great Britain fell -0.4% year-on-year in August 2025 to £1,387 per calendar month, a saving of £6 per month.

Hampsons says this is the largest annual fall post-Covid and the joint second-largest annual fall in rents since it began tracking lettings costs in March 2011.

New rents are falling most sharply in London, Hamptons says.

Inner London rents fell by 5.8% over the last 12 months, the largest decline since May 2021, while overall across the capital they are 3.3% lower than a year ago, according to its data.

Aneisha Beveridge, head of research at Hamptons, says “the tide is finally turning”, after several years of rapid rental growth, explaining:

For the ninth month in a row, rents have risen more slowly than inflation—offering tenants a rare moment of financial respite. While the monthly savings may seem modest, they mark a significant shift in the rental market’s role in driving inflation.

“Over the longer term, rents have consistently outpaced inflation, which means tenants today are paying more than they would have if rents had simply tracked CPI. For the most part, this has mirrored the rising cost pressures facing landlords. But this recent slowdown suggests the market is recalibrating. With affordability stretched and demand softening, landlords are having to adjust to attract tenants.

“Like wages, rents don’t often fall. In fact, there have only been six months over the last 14 years when rents have fallen nationally on an annual basis.

Autumn budget tax jitters ‘risk slowing the market’

Rightmove adds that it’s not seeing any “immediate reaction” from movers to rumours that chancellor Rachel Reeves may change property taxes.

But, it cautions that speculation about the Autumn Budget risk slowing the parts of the market that are already underperforming (ie, the South, and London).

Rightmove’s Colleen Babcock explains:

Rumours of property tax changes began swirling in mid August, and with the Budget itself not arriving until the end of November, this kind of extended uncertainty can affect market activity, especially in the higher price brackets.

Movers want to be confident in planning their moving costs.

Our real-time data has not yet picked up any major shifts, however it’s understandable that those who could be negatively affected by the rumoured changes might be in the process of reassessing their short- and medium-term plans.

Last month, the Guardian reported that the Treasury is considering a new tax on the sale of homes worth more than £500,000, in a move towards a radical overhaul of stamp duty and council tax.

According to Rightmove, more than half (59%) of agreed property sales in London so far this year have been over £500,000 and would be subject to the speculated new tax replacing stamp duty, versus an average of 22% outside London.

Introduction: First annual drop in UK houses asking prices since January 2024

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The UK housing market appears to be cooling, driven by London and the south of England.

New figures from property portal Rightmove this morning show that the average asking price on a UK home is 0.1% lower than this time last year, following several months of muted price growth.

That’s the first annual decline in asking prices since January 2024, which Rightmove attribute to several months of “competitive pricing” by new sellers over the summer, as some cut prices to secure a buyer.

The decline in asking prices is mainly seen in the south of the country; they’re down 1.1% in London, -0.7% in South East England, and -1.3% in the South West.

In contrast, asking prices are still 2.6% higher than a year ago in Scotland, and 3.2% higher in the North West of England.

On a month-on-month basis, though, Rightmove reports that the average asking price rose by 0.4% (+£1,517) to £370,257.

Colleen Babcock, property expert at Rightmove, explains:

“We’d expect to see a slight uptick in new seller asking prices in September, with the traditional back to school season boosting activity heading into autumn. This year’s 0.4% September price rise is a little lower than the norm, which is an average of 0.6% at this time of year.

However, prices have now dipped slightly from where they were at this time last year after a summer of competitive pricing by sellers, and it’s the south of England which is driving this small dip. It’s the sensible and attractive seller pricing we’ve been reporting which has been helping to drive more sales activity compared to last year. Static house prices, rising wages, and lower mortgage rates all assist buyer affordability, which has led to an increase in the number of sales agreed compared to a year ago.”

The agenda

-

10am BST: Eurozone trade balance for July

-

Noon: Bank of International Settlements’ Quarterly Review of financial markets

-

1.30pm BST: US Empire State Manufacturing Index