Introduction: UK retail sales weaker than expected

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

After a disappointing autumn, retail sales across Great Britain have returned to growth – helped by early Black Friday offers.

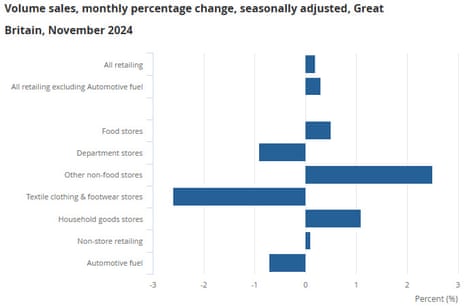

Retail sales volumes across the country rose by 0.2% month-on-month in November, new data from the Office for National Statistics show – following a 0.7% fall in October when budget uncertainty gripped the economy.

November is a key month in the Golden Quarter for retailers, but these figure aren’t exactly sparkling. While retailers will welcome any pick-up in trading, November’s sales are weaker than expected – economists had forecast a 0.5% rise.

Sales rose at supermarkets and other non-food stores, but there was a drop in takings at clothing retailers.

Neil Birrell, chief investment officer at Premier Miton Investors, says the data suggests consumers are “feeling the pinch in a sluggish economy”.

Birrell adds:

With the Bank of England keeping interest rates on hold [yesterday] and inflation in the system, there are concerns around growth prospects as we go into the new year. Christmas is a key period for retail sales and will give a further clue on short term outlook and may influence the BoE at its next meeting.

Unfortunately, the data doesn’t directly capture what happened on Black Friday, which fell on 29th November – but the ONS has adjusted its data to reflect that.

ONS senior statistician Hannah Finselbach explains:

“Retail sales increased slightly in November following last month’s fall.

“For the first time in three months there was a boost for food store sales, particularly supermarkets. It was also a good month for household goods retailers, most notably furniture shops.

“Clothing store sales dipped sharply once again, as retailers reported tough trading conditions.

“With November’s retail sales survey covering the four weeks to the 23 November, Black Friday itself will fall within December’s figures. However, our figures account for this shift in timing to give us the best picture of what is happening in the shops.”

The agenda

-

7am GMT: UK retail sales report for November

-

7am GMT: UK public finances report fro November.

-

10.30am GMT: Bank of Russia’s interest rate decision

-

1.30pm GMT: US PCE inflation measure for November

-

3pm GMT: Universiy of Michigan survey of US consumer confidence 3pm

Key events

FTSE 100 on track for worst week of the year

London’s stock market is sliding this morning, as investors worry that the US government could shut down tonight in a spending row.

The FTSE 100 index of blue-chip shares has dropped by 55 points, or 0.7%, to 8050 points, with banks among the big fallers.

That means the FTSE 100 has lost 3% of its value this week, the worst weekly drop since August 2023.

European stock markets are also in the red, with Germany’s DAX and France’s CAC 40 both down 1.15%.

The selloff comes as the US government teeters on the brink of a shutdown, after a budget deal backed by President-elect Trump failed to pass Congress last night.

Congress failed to pass a pared-down spending bill, after an earlier bipartisan deal was scuppered by Trump and Elon Musk.

The new bill had included the suspension on the US debt limit fro two years, which would have make it easier for Trump to pass large tax cuts and drive the US national debt even higher.

Government funding is due to expire at midnight on Friday. If Congress fails to extend that deadline, the US government will begin a partial shutdown.

Paul Donovan, chief economist at UBS Global Wealth Management,says:

Absent a deal, the US government starts to shut down tonight. A short-lived shutdown affects government workers, but has limited economic impact.

The longer a shutdown lasts, the more disruptive it is to the US economy. Economic data may not get published in a shutdown (a problem for Federal Reserve Chair Powell with their addiction to data dependency).

UK suffers worst November for car production since 1980

There wasn’t much pre-Christmas cheer in the UK automobile sector last month.

The UK recorded its worst November car production numbers in over 40 years, as manufacturers were hit by amid weak demand both in Britain and across Europe.

Just 64,216 new cars rolled off UK factory lines, the worst performance for any November since 1980. Output for the domestic market fell 56%, while exports were down 21%.

Car manufacturing down in November as sector seeks an easing of cost pressures

🚗 production falls -30.1% in November with 64,216 units rolling off factory lines.

📉Output for domestic and export markets decline -56.7% and -21.3% respectively

⚡️Year to date volumes down -12.9%… pic.twitter.com/urIJV2XYbz— SMMT (@SMMT) December 20, 2024

Output was also hit by factory disruption as manufacturers transition to mak electric vehicles.

Mike Hawes, SMMT chief executive, says:

While a decline was to be expected given the extensive changes underway at many plants, manufacturing is under pressure at home and abroad, with billions of pounds committed to new technologies, new models and new production tooling.

Government can help by supporting consumers in the transition, fast tracking its Industrial Strategy for advanced manufacturing and, most urgently, reviewing the market regulation which is putting enormous strain on the sector.

Christmas ‘comes early’ for the Chancellor as borrowing undershoots expectations

“Christmas has come early” for chancellor Rachel Reeves with borrowing undershooting expectations in November (see earlier post).

So says Ruth Gregory, deputy chief UK economist at City consultancy Capital Economics, who told clients:

Not only was borrowing (on the PSNB ex banks measure) of £11.2bn well below the consensus forecast of £13.0bn, but it was £3.4bn lower than in November 2023 and the lowest November borrowing in three years.

The breakdown revealed that £2.4bn higher spending on public sector pay left total current expenditure in the year-to-date £17.7bn higher than at the same stage last year. But due to the recent strength in wage growth and fixed personal tax thresholds, total tax receipts were £3.2bn higher than in November 2023.

But while borrowing has dipped to just over £11bn last month, the recent weakening the economy – and the rise in market interest rates – could make it hard for Reeves to bring the deficit down as quickly as planned.

That raises the chances that extra revenue-raising tax hikes or spending cuts will be required, Gregory says:

Charlie Huggins, manager of the Quality Shares Portfolio at Wealth Club, also sees little Christmas cheer in the retail sales report:

“The UK consumer appears to be limping towards the finish line in 2024 – retail sales volumes came in slightly below expectations in November, with a good performance from food the only real highlight.

Online sales were weak across the board and there was little Christmas cheer on offer for clothing retailers. The 2.6% decline in clothing sales in November means clothing sales volumes are at their lowest in almost three years. With clothing often the first category consumers cut back on in difficult times, this is not a good omen.

Capital Economics: Little festive cheer for retailers

There’s “little festive cheer for retailers” in today’s sales figures, reports Alex Kerr, UK economist at Capital Economics.

Not only was the rise in sales lower than expected on November, sales are still on course to decline in the October-December period, Kerr explains, adding;

Given that October’s 0.7% m/m (month-on-month) fall in sales volumes appeared to be driven by households spending cautiously ahead of possible tax rises in the Budget and that the Chancellor avoided large personal tax rises, it is somewhat encouraging that sales volumes rebounded in November.

That was helped by the ONS seasonal adjustment capturing the unusually late timing of Black Friday this year.

But the breakdown of sub-sectors was “a mixed bag”, Kerr explains:

Sales volumes in ‘other’ stores and household goods stores rose by 2.5% m/m and 1.1% m/m respectively. And food stores posted a 0.5% m/m gain.

But sales at department stores fell by 0.9% m/m and sales at clothing stores followed October’s 3.5% m/m drop with a further 2.6% m/m decline as households continued to delay spending on winter clothing. And fuel sales fell by 0.7% m/m, probably as petrol pump prices rose by 0.9% m/m.

UK government borrowing drops, to £11.25bn

We also have new data showing a fall in government borrowing.

The UK government borrowed almost £11.25bn last month, the lowest November figure in three years, helped by a rise in tax receipts and a drop in interest payments on the national debt.

The Office for National Statistics (ONS) reports that public sector net borrowing was £3.4bn lower than in November 2023 – lower than the £13bn expected.

Happily for the Treasury, the interest bill on central government debt more than halved to £3bn in November; that’s £4.7bn less than in November 2023 and the lowest November figure for five years.

The drop was due to the recent fall in the RPI inflation measure, which is used to set the interest rate on many government gilts.

ONS deputy director for Public Sector Finances Jessica Barnaby says:

“Borrowing this month was over £3 billion less than this time last year and the lowest November borrowing for three years. Central government tax receipts grew compared with last year, while increased spending on public services and on benefits were offset by lower debt interest payable.”

Introduction: UK retail sales weaker than expected

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

After a disappointing autumn, retail sales across Great Britain have returned to growth – helped by early Black Friday offers.

Retail sales volumes across the country rose by 0.2% month-on-month in November, new data from the Office for National Statistics show – following a 0.7% fall in October when budget uncertainty gripped the economy.

November is a key month in the Golden Quarter for retailers, but these figure aren’t exactly sparkling. While retailers will welcome any pick-up in trading, November’s sales are weaker than expected – economists had forecast a 0.5% rise.

Sales rose at supermarkets and other non-food stores, but there was a drop in takings at clothing retailers.

Neil Birrell, chief investment officer at Premier Miton Investors, says the data suggests consumers are “feeling the pinch in a sluggish economy”.

Birrell adds:

With the Bank of England keeping interest rates on hold [yesterday] and inflation in the system, there are concerns around growth prospects as we go into the new year. Christmas is a key period for retail sales and will give a further clue on short term outlook and may influence the BoE at its next meeting.

Unfortunately, the data doesn’t directly capture what happened on Black Friday, which fell on 29th November – but the ONS has adjusted its data to reflect that.

ONS senior statistician Hannah Finselbach explains:

“Retail sales increased slightly in November following last month’s fall.

“For the first time in three months there was a boost for food store sales, particularly supermarkets. It was also a good month for household goods retailers, most notably furniture shops.

“Clothing store sales dipped sharply once again, as retailers reported tough trading conditions.

“With November’s retail sales survey covering the four weeks to the 23 November, Black Friday itself will fall within December’s figures. However, our figures account for this shift in timing to give us the best picture of what is happening in the shops.”

The agenda

-

7am GMT: UK retail sales report for November

-

7am GMT: UK public finances report fro November.

-

10.30am GMT: Bank of Russia’s interest rate decision

-

1.30pm GMT: US PCE inflation measure for November

-

3pm GMT: Universiy of Michigan survey of US consumer confidence 3pm