China’s industrial policy blueprint for building sectoral superstars in biotech and automobiles has Washington worried that the United States is falling behind. In many areas, it already has.

David Lin, former economic officer in the U.S. Consulate in Shanghai, told members of the U.S.–China Economic and Security Review Commission (USCC) on Feb. 6, during a day-long hearing, that the “Made in China 2025” policy was seen by Beijing as a “reawakening” for the country. Lin was in Shanghai at the time Made in China 2025 was launched. He said there was a sense that China no longer wanted to be merely a manufacturing hub for the West, but wanted to be a brand leader, and innovator, instead.

“At the time, the idea of China producing a technology on par with the iPhone seemed very far-fetched, yet fast forward a decade, here we are. Companies like Huawei, ZTE, Xiaomi are not just competing, but they’re shaping the global tech industry and beyond,” he said. “[China] is positioning itself to lead.”

The USCC is a bipartisan, congressional commission established by Congress in 2000. Its purpose is to monitor, investigate, and report on the national security and economic implications of the U.S.–China relationship. It holds roughly six hearings a year. The recent hearing focused on the rivalry between the world’s top two economic superpowers.

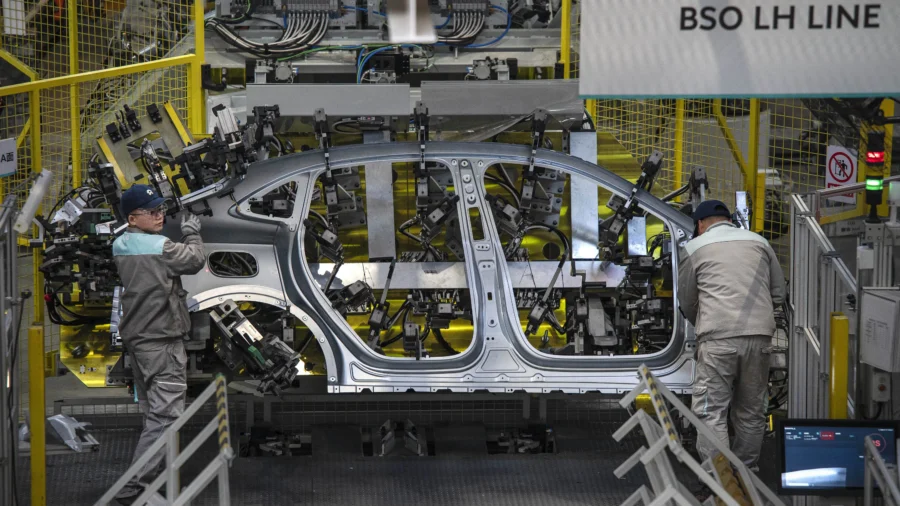

China’s comparative position is strong. Its industrial prowess is unmatched, Lin told the commission. He cited advanced technology sectors like EV batteries, 5G infrastructure, and commercial and retail drones as some of the new economy sectors currently dominated by Chinese companies.

A United Nations Industrial Development Organization study published in October 2024 predicts China will account for 45 percent of global industrial production by 2030 while the United States slips from 25 percent in 2000 to just 11 percent in 2030. China accounted for only 6 percent in 2000, a year before it became a member of the World Trade Organization (WTO).

China Commission Asks ‘Who Is Winning?’ Some Say It’s Up for Debate

The Made in China 2025 policy launched in 2015. The document laid out goals for China’s manufacturing economy for the next 10 years, with a focus on renewable energy technologies, reduced foreign dependence, and creating global corporate brands that can become household names alongside South Korean, Japanese, and Western brands.

In many segments, China has succeeded in what it has set out to do. China is the world’s leading EV producer and most Western EVs, including Tesla, are dependent on Chinese battery makers like CATL. TikTok is on almost every American teenager’s cell phone.

Temu and Shein were the most downloaded retail apps in the United States in 2024, according to the Sensor Tower State of Mobile 2025 survey.

“Beijing is using industry to overtake and to overpower the United States. This is the ambition in Made in China 2025. … The stakes for the U.S. are enormous,” said Emily de La Bruyère, co-founder of Horizon Advisory, a business intelligence firm. She took part in the commission hearing last week.

“Should the CCP realize its ambitions, the U.S. industrial and defense industrial bases will become entirely reliant on China. … Beijing will be able to shape the American political and social system that depends on and is influenced by markets,” she said in her opening remarks, adding that Washington has mostly played defense against China or tried to out-subsidize China in programs like the CHIPS Act and the Inflation Reduction Act, signed into law by former President Joe Biden. She said it will be hard for Washington to out-subsidize China.

“The first step in [a U.S. policy for industry] is real system level action that alters China’s distortive role in the international trade system to level the playing field,” she said, advocating for removing China’s Permanent Normal Trade Relations status with the United States, a status granted to mostly every member of the WTO. Such a move would instantly raise tariffs on China imports, though tariffs on most China goods are already at least 25 percent, with Trump raising them another 10 percentage points on Feb. 1.

Commission member Aaron Frieberg, a Princeton University professor of international relations and a senior fellow at the American Enterprise Institute, raised concerns others may have about removing China from the international trading system.

“It’s going to drive up costs. We can’t just do without China suddenly. We’re highly dependent on them for all kinds of intermediate goods,” Frieberg said.

Reva Price, chairwoman of the commission, asked who was winning, China or the United States.

“Who is doing a lot of the winning right now, continuously, is China. However, I do believe that the United States is still ahead,” said Tim Khang, director of global intelligence at Strider Technologies based in South Jordan, Utah.

Hanna Dohmen, research analyst at Georgetown University’s Center for Security and Emerging Technology, told the commission she thought the United States was still ahead on computer chips, “but we are buying time. … [I’d say we are] currently winning, but it’s a window of opportunity that we need to take advantage of.”

De La Bruyère was more bearish. “We can’t make without China,” she said. “But China can make without us.”

Lin said that despite China being a top down, state-run operation, the country is faster than expected at innovating and bringing new products to market, as the recent surprise launch of the DeepSeek R1 AI model has shown.