Economists predict BoE rate cut in March after inflation falls

Many economists are predicting the Bank of England will cut interest rates in March, after seeing inflation fall to 3% this morning.

The money markets now indicate there’s an 86% chance of a rate cut in March (taking Bank rate down from 3.75% to 3.5%), at next month’s meeting.

That’s up from 77% last night, and 65% a week ago.

Yael Selfin, chief economist at KPMG UK, says the fall in inflation in January “paves the path for a March interest rate cut”.

“Today’s inflation data will likely prompt the Bank of England to lower interest rates next month. The MPC will welcome the broad-based fall in inflation, with both headline and underlying measures of inflation easing. Given the favourable inflation outlook, the Bank is expected to cut interest rates three times this year, leaving interest rates at 3% by the end of 2026.

“Headline inflation has gradually eased since last summer and is expected to fall further as food and energy prices drop. The combined impact of the government’s energy bill package and the fall in wholesale gas prices could see household energy bills decrease by around 7% from April. Forward-looking data also points to food prices softening over the coming months, as recent declines in global food prices are passed on to households, with the recent adverse weather episodes across Europe not yet making their mark.

Rob Morgan, chief investment analyst at wealth manager Charles Stanley, predicts at least two interest rate cuts this year:

Another reduction as soon as the March meeting is now firmly on the table, and that’s unlikely to be the end of the matter with one or two further cuts likely as the year progresses.

The Bank’s latest decision highlights just how close the committee already is to moving. The MPC voted 5-4 to hold Bank Rate at 3.75%, far tighter than the widely expected 7–2 split. Notably, long‑time hawk Catherine Mann signalled her position is shifting, acknowledging that new analysis has “moved the appropriate time for a cut closer.” With Governor Bailey’s vote pivotal and Mann softening, the MPC’s balance is clearly tilting toward easing.

The Bank’s updated projections reinforce that shift. It now expects CPI to fall to 2.1% by the second quarter of 2026, down from 2.8% in the previous forecast, driven by lower energy costs and fiscal measures from the Autumn Budget. More strikingly, inflation is projected to dip below target to 1.7% next year and to remain subdued through 2028 – a sharp departure from earlier forecasts that had inflation above target into the 2030s.

TUC general secretary Paul Nowak is urging the Bank to act fast:

“Inflation easing is welcome news for working people.

“And it’s right that the government has reduced the pressure – cutting energy bills, freezing rail fares and prescription charges, and raising the minimum wage.

“But after years of falling living standards millions of families are still struggling to make ends meet.

“With households squeezed there’s less money being spent on the high street – holding back businesses and choking off growth.

“The Bank of England must now act.

“From next month we need a series of quick fire interest rate cuts.

“That would put money back into people’s pockets, give businesses the confidence to invest and help Britain finally move on from a cost-of-living crisis that has dragged on for far too long.”

Key events

Looking back at UK inflation, economist Kallum Pickering of Peel Hunt says here is a “clear risk” that the Bank of England has fallen behind the curve by not cutting rates faster.

That means it may have to cut borrowing costs more rapidly than the two rate reductions expected by the City this year, Pickering suggests.

Clear downward trend in UK headline inflation towards the BoE’s 2% target. Looking at annualised data, which gives a better measure of current price pressures, the BoE is now undershooting its target. Given known lags with monetary policy, the clear risk now is that the bank has… pic.twitter.com/hcG066CGBd

— Kallum Pickering (@KallumPickering) February 18, 2026

Rent and house price inflation slows

Just in: Rent and house price growth have both slowed across the UK.

The ONS has reported that average private rents increased by 3.5%, to £1,367 per month, in the 12 months to January 2026, down from 4% in December 2025.

Average rents increased by 3,5% in England, 5.8% in Wales, 2.6% in Scotland, and 5.6% in Northern Ireland.

Within England, private rents annual inflation was highest in the North East (8.0%), and lowest in London (1.1%), in the 12 months to January 2026.

Rental growth slowed by 3.5%, to £1,367, in the 12 months to January 2026 but remains an increasing financial drain. The North East reported the highest private rental annual inflation, up 8.0% while stretched London grew only 1.1% in the 12 months to January 2026 @ONS pic.twitter.com/5CIlzK1wdR

— Emma Fildes (@emmafildes) February 18, 2026

Annual house price inflation slowed too – to 2.4% in the 12 months to December 2025, down from 2.8% in November.

Raspberry Pi shares soar again on hopes of AI OpenClaw boost

Back in the City, shares in UK tech firm Raspberry Pi are soaring for the third day running.

Raspberry Pi, which makes cheap, simple-to-use durable minicomputers, are up 21% this morning. That follows a 7.5% rise on Monday, and a 36% surge on Tuesday.

Having been created to inspire a generation of child programmers, by providing a cheap piece of hardware to code with, Raspberry Pi is now caught up in speculation that it could be a winner from the AI boom.

The theory is that Raspberry Pi’s low-cost computers are ideal for running OpenClaw, a popular AI personal assistant.

OpenClaw, previously known as Moltbot, and Clawdbot, is billed as “the AI that actually does things”, such as managing email or calendar applications, through a chat app such as WhatsApp or Telegram.

One issue, though, is that to do this OpenClaw needs access to a user’s accounts and their credentials, creating security fears (The Register has details here).

That prompted some users to buy new Apple Mac minis to run the AI agent on – but Raspberry Pi’s system is seen as a more affordable alternative.

Technology researcher Andrew Fisher has explained here how he got OpenClaw running on a simple Raspberry Pi.

This post on X, arguing why Raspberry Pi should benefit from the Openclaw boom, has been credited with pushing its shares higher this week.

But, don’t forget those security concerns.

Heather Adkins, VP of security engineering at Google Cloud, has urged people to avoid installing the agentic AI tool:

But rate cut might not come until April

Not every economists expects a rate cut in March, though.

Ellie Henderson of Investec reckons the BoE’s monetary policy committee will hold off cutting until April.

Henderson points out that the Bank had expected inflation to drop to 2.9% in January, so today’s reading of 3% is slightly higher than it forecast:

For now though, inflation at 3.0% is still some way above the Bank of England’s 2.0% target, meaning that caution should still prevail when it comes to loosening policy further. On the economic data available to us thus far, our base case remains that the next cut will not be until April, with the fact that today’s numbers exceeded the Bank of England projection a reason to support that call.

However the risk of a March cut has certainly risen over the past month or so, not least because it seems as if there are more dovish voices on the committee than we previously thought. We next look to retail sales data for January, and ‘flash’ PMIs for February at the end of the week to provide a more rounded view of the health of the UK economy and the implications that has for price pressures.

Debapratim De, director of economic research at Deloitte, is also in the April camp, saying:

“The sharp slowing of price rises in January is consistent with expectations of inflation plummeting over the coming months. A substantial reduction in energy bills, much slower rises in regulated prices compared to last year, and a moderation in food price rises are set to bring headline inflation at or close to the Bank of England’s 2% target in April.

“This, alongside a softening labour market, should create room for further interest rate cuts. Recent MPC voting patterns and today’s data point to an earlier easing than markets foresee. We expect two 25-basis-point cuts between now and autumn, with the first cut coming in April.”

Professor Costas Milas, of the University of Liverpool’s Management School, argues that the case for a March rate cut is ‘not that straightforward’, telling us:

We might as well trust the forecasting instincts of the public which predicted 2. 8% one year ago (compared to the poor 2.3% forecast of the BoE).

When I decompose inflation to its drivers, I find that the latest cuts in Bank Rate are unfortunately keeping inflation higher than it should be.

Therefore, I agree with BoE’s Chef Economist Huw Pill who noted that we “need to retain some restrictiveness in the stance of monetary policy until that process of disinflation is complete”. In other words, we should wait to see a drop in inflation closer to 2.5% before the MPC cuts Bank Rate further. The next inflation reading is on the 25th of March, that is, after the MPC’s March decision (on the 19th of March).

Economists predict BoE rate cut in March after inflation falls

Many economists are predicting the Bank of England will cut interest rates in March, after seeing inflation fall to 3% this morning.

The money markets now indicate there’s an 86% chance of a rate cut in March (taking Bank rate down from 3.75% to 3.5%), at next month’s meeting.

That’s up from 77% last night, and 65% a week ago.

Yael Selfin, chief economist at KPMG UK, says the fall in inflation in January “paves the path for a March interest rate cut”.

“Today’s inflation data will likely prompt the Bank of England to lower interest rates next month. The MPC will welcome the broad-based fall in inflation, with both headline and underlying measures of inflation easing. Given the favourable inflation outlook, the Bank is expected to cut interest rates three times this year, leaving interest rates at 3% by the end of 2026.

“Headline inflation has gradually eased since last summer and is expected to fall further as food and energy prices drop. The combined impact of the government’s energy bill package and the fall in wholesale gas prices could see household energy bills decrease by around 7% from April. Forward-looking data also points to food prices softening over the coming months, as recent declines in global food prices are passed on to households, with the recent adverse weather episodes across Europe not yet making their mark.

Rob Morgan, chief investment analyst at wealth manager Charles Stanley, predicts at least two interest rate cuts this year:

Another reduction as soon as the March meeting is now firmly on the table, and that’s unlikely to be the end of the matter with one or two further cuts likely as the year progresses.

The Bank’s latest decision highlights just how close the committee already is to moving. The MPC voted 5-4 to hold Bank Rate at 3.75%, far tighter than the widely expected 7–2 split. Notably, long‑time hawk Catherine Mann signalled her position is shifting, acknowledging that new analysis has “moved the appropriate time for a cut closer.” With Governor Bailey’s vote pivotal and Mann softening, the MPC’s balance is clearly tilting toward easing.

The Bank’s updated projections reinforce that shift. It now expects CPI to fall to 2.1% by the second quarter of 2026, down from 2.8% in the previous forecast, driven by lower energy costs and fiscal measures from the Autumn Budget. More strikingly, inflation is projected to dip below target to 1.7% next year and to remain subdued through 2028 – a sharp departure from earlier forecasts that had inflation above target into the 2030s.

TUC general secretary Paul Nowak is urging the Bank to act fast:

“Inflation easing is welcome news for working people.

“And it’s right that the government has reduced the pressure – cutting energy bills, freezing rail fares and prescription charges, and raising the minimum wage.

“But after years of falling living standards millions of families are still struggling to make ends meet.

“With households squeezed there’s less money being spent on the high street – holding back businesses and choking off growth.

“The Bank of England must now act.

“From next month we need a series of quick fire interest rate cuts.

“That would put money back into people’s pockets, give businesses the confidence to invest and help Britain finally move on from a cost-of-living crisis that has dragged on for far too long.”

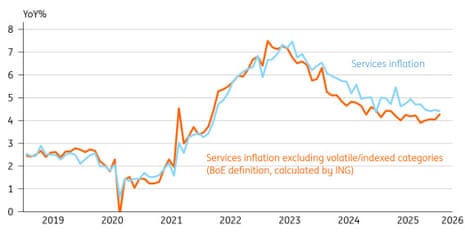

ING: Services inflation is proving sticky

Economists at ING are concerned that UK services inflation is looking ‘sticky’.

James Smith, ING’s developed markets economist, explains:

Headline inflation is down from 3.4% to 3.0% in January, largely as expected. It’s a consequence of a seasonal fall in air fares, lower fuel prices and the impact of last year’s private school VAT change dropping out.

Most importantly, though, food inflation is down sharply – from 4.5% to 3.6%. That’s roughly inline with BoE forecasts, but it should help the hawks become a little more relaxed about the upside risks to inflation. A big concern last year was that higher food inflation would spark a much wider and more persistent bout of price pressure. Those concerns now look overblown.

But services inflation was stickier than expected in January. Importantly, that’s not really because of quirks like air fares or holidays. In fact, we calculate that the Bank’s preferred measure of ‘core services’ inflation nudged up from 4.0% to 4.3%, once volatile and indexed items are excluded. Catering – often seen as the archetypal service-sector category, one that’s driven by underlying economic demand – has nudged a little higher over the past couple of months.

Education inflation slowed in January, the ONS reports.

That’s because it’s now a year since the government brought in VAT on private school fees. That lifted education prices in January 2025 onwards, so we’ve now caught up with that effect in the annual inflation basket.

The ONS explains:

Prices in the education division rose by 5.1% in the 12 months to January 2026, down from 7.6% in the 12 months to December 2025. On a monthly basis, prices were unchanged in January 2026, compared with a rise of 2.4% a year ago.

The downward contribution came entirely from private school fees, which rose by 12.7% a year ago after they became subject to Value Added Tax (VAT), and there was no change in price in January 2026.

FTSE 100 hits record high

Britain’s stock market has hit a fresh alltime high at the start of trading in London.

The FTSE 100 index of blue-chip shares has gained 41 points, or 0.4%, to a new intraday. high of 10,597 points, as investors anticipate cuts to UK interest rates this year as inflation eases.

That means it has gained 6.6% so far this year.

Weapons maker BAE Systems is the top riser, up 5% after beating City forecasts with a 12% rise in operating profits for the last year.

Chief executive Charles Woodburn told investors:

“In a new era of defence spending, driven by escalating security challenges, we’re well positioned to provide both the advanced conventional systems and disruptive technologies needed to protect the nations we serve now and into the future,”

Core inflation dropped in January too

Encouragingly, underlying inflation also dropped in January.

Core CPI (which strips out energy, food, alcohol and tobacco) rose by 3.1% in the 12 months to January 2026, down from 3.2% in December 2025.

Goods inflation dropped from 2.2% to 1.6%, while services inflation slipped from 4.5% to 4.4%.

Derrick Dunne, CEO of YOU Asset Management, says this is a ‘crucial’ move in core inflation.

“This is a significant slowdown in the rate of inflation and effectively clears the way for the Bank of England to proceed with rate cuts, especially given the broader picture of faltering GDP growth and labour market weakness.

“Perhaps most crucial in today’s data is that core inflation has now fallen to its lowest level since September 2021. Core inflation has remained stubbornly high for a number of years now and has been one of the main drivers of rate caution from the Monetary Policy Committee in recent decisions.

“Rate cuts are already priced in by markets, but if employment and GDP figures continue to disappoint then we could see rate cut expectations grow. This could come from additional cuts beyond the two forecast in March and June or from larger cuts to get ahead of the economic slowdown.”

Chancellor Rachel Reeves is trying to take the credit for the drop in inflation to 3% in January, saying:

“Cutting the cost of living is my number one priority.

Thanks to the choices we made at the budget we are bringing inflation down, with £150 off energy bills, a freeze in rail fares for the first time in 30 years and prescription fees frozen again.

Our economic plan is the right one, to cut the cost of living, cut the national debt and create the conditions for growth and investment in every part of the country.”

Fact check: The £150 cut to energy bills announced in the budget begins in April, so isn’t a factor behind January’s drop in inflation [it WILL lower inflation in April, though]

And the freeze on NHS prescription charges is for the 2026/27 financial year.

Food inflation lowest since April 2025 after prices fall in January

Food inflation has dropped to its lowest level in nine months, easing the cost of living squeeze on households.

The ONS reports that food and non-alcoholic beverages prices rose by 3.6% in the 12 months to January 2026, down from 4.5% in the 12 months to December 2025

On a monthly basis, food and non-alcoholic beverages prices fell by 0.1% in January 2026, compared with a rise of 0.9% a year ago.

The ONS reports that price fell month-on-month in six food categories, including bread, meat, and dairy products.

-

bread and cereals – down 0.04 percentage points

-

meat – down 0.02 percentage points

-

milk, cheese and eggs – down 0.01 percentage points

-

food products not elsewhere classified – down 0.01 percentage points

-

coffee, tea and cocoa – down 0.01 percentage points

-

mineral waters, soft drinks and juices – down 0.01 percentage points

Dr Liliana Danila, lead economist at The Food and Drink Federation, (FDF), says:

“It’s positive to see a lower rate of food inflation in January, however it still remains a real worry for household budgets and above long-term averages. After many years of rising costs businesses across the supply chain have had their margins eroded, leaving manufacturers particularly susceptible to the supply chain shocks caused by geopolitics or climate change. We’ve previously seen the impact that this can have on inflation, with prices of ingredients like cocoa and coffee skyrocketing, so the UK’s recent extreme wet weather flooding farms is a concern for the year ahead.

“To help stabilise food inflation in the long term and protect shoppers from future price spikes, government must incentivise investment in business resilience.”