Introduction: Bailey says Bank could become ‘a bit more activist’ on interest rates

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

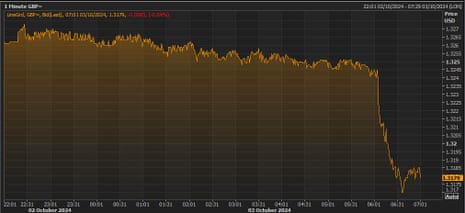

The pound has dropped to a two-week low this morning, after the Bank of England governor told the Guardian that the central bank could become a “bit more aggressive” in cutting interest rates provided the news on inflation continued to be good.

Andrew Bailey told us that he has been encouraged by the fact that cost of living pressures had not been as persistent as the Bank thought they might be.

In an interview with my colleague Larry Elliott, Bailey says that if the news on inflation continued to be good there was a chance of the Bank becoming more “a bit more activist” in its approach to cutting interest rates, now at 5%.

This has knocked the pound, which is down 0.8 of a cent to $1.3185, its lowest level since 19 September (just before the Fed’s rate cut).

The Bank had recently sounded more cautious about rate cuts than its counterparts in the US and the eurozone. It has only made one quarter-point cut this year, in August, while the Federal Reserve has cut US rates by half a point, and the European Central Bank has made two quarter-point cuts since June.

The Bank is next scheduled to set interest rates in early November; the money markets suggest there’s an 88% chance of a cut, to 4.75%.

Bailey made the comments in a wide-ranging inteview, in which he explained he was watching developments in the Middle East “extremely closely”.

Bailey told us:

“Geopolitical concerns are very serious,.

It’s tragic what’s going on. There are obviously stresses and the real issue then is how they might interact with some still quite stretched markets in places.”

Bailey said that in the year since the Hamas attack on Israel there had not been a big rise in oil prices of the sort seen in the past.

He explained:

“From the point of view of monetary policy, it’s a big help we haven’t had to deal with a big increase in the oil price. But obviously we’ve had that experience in the past, and in the 1970s, the oil price was a big part of the story.

“Obviously, we keep watching it. We watch it extremely closely to see the impact of the latest news. But … my sense from all the conversations I have with counterparts in the region, is that there is, for the moment, a strong commitment to keep the market stable.

Here’s the full interview:

The agenda

-

9am BST: Eurozone services PMI index for September

-

9,30am BST: UK services PMI index for September

-

10am BST: Eurozone producer prices index for August

-

12.30pm BST: Challenger survey of US job cuts for September

-

1.30pm BST: US weekly jobless claims report

Key events

Pound on track for worst day in 18 months

Today is turning into the pound’s worst day in over 18 months.

Currently, sterling is down almost 1.4% today against the US dollar at $1.311, a drop of 1.5 cents.

That would be its biggest one-day drop against the dollar since 7 March 2023.

Today’s comments from Andrew Bailey have “challenged investors’ expectations” that the BoE, faced with persistent price pressures in the key services sector, would cut rates far more slowly than the Federal Reserve and the European Central Bank.

So says the Financial Times, adding;

“Given that inflation in the UK has been higher than in the US and Europe, the market has been pricing a shallower cycle,” said Athanasios Vamvakidis, global head of G10 FX strategy at BofA.

“But these comments suggest that the BoE could go faster.”

The pound has now fallen by around 2% against the US dollar so far this week.

Around half of that is today’s fall. The other half largely came on Tuesday, when Iran’s missile attack on Israel led investors to rush into safe-haven assets such as the dollar.

This chart from brokerage XM shows major asset price changes this morning – with the pound’s slide against the US dollar at the bottom:

Charalampos Pissouros, senior investment analyst at XM, says

Today, it was the pound’s turn to tumble as BoE Governor Bailey said in an interview with the Guardian that they could turn “a bit more activist” on interest rate cuts if data continues to suggest progress in inflation.

The market is now nearly fully convinced that a quarter point cut will be delivered in November, assigning a 65% probability for another one in December.

Geopolitical risks may have prompted the Bank of England’s governor to hint at faster interest rate cuts, suggests Professor Costas Milas of the University of Liverpool.

Prof Milas tells us:

Andrew Bailey, and rightly so, notes that the Bank’s MPC might cut more aggressively if the news on inflation continue to be good. But this is a given. So, why his comments now? It is not a coincidence that Bailey’s comments coincide with geopolitical risk, fuelled by tensions between Israel and Iran, being on the rise.

As my colleague Mike Ellington and I have noted in an LSE Business Review blog, rising geopolitical risk impacts negatively, and strongly, on four-quarter UK output growth within two to three quarters.

My argument is that Bailey had (also) this negative output scenario in mind when talking about further interest rate cuts.

Pound drops to three-week low

The pound continues to slide against the US dollar – it’s now down a cent and a half, at $1.3115, which is a three-week low.

Michael Brown, senior research strategist at brokerage Pepperstone, reckons the markets may be overdoing it…

The actual remarks from BoE Gov Bailey are *way* more caveated than the way markets appear to have interpreted them…cable off over 1% on this seems rather over-done… pic.twitter.com/lrv7zAS19C

— Michael Brown (@MrMBrown) October 3, 2024

Data just released by the Bank of England shows that UK businesses have trimmed their inflation expectations.

The Bank’s latest ‘decision makers panel’ survey shows that expectations for CPI inflation a year ahead have dropped by 0.1 percentage point to 2.6%.

Firms also expect inflation to be 2.6% in three years time, which is also a drop of 0.1 percentage points compared with last month’s report.

These expectations are important, as they influence how fast companies will expect to raise their own prices.

Firms are still expecting to make inflation-beating pay rises, too.

The Bank explains:

Expected year-ahead wage growth remained unchanged at 4.1% on a three-month moving-average basis in September. Annual wage growth was 5.7% in the three months to September, 0.1 percentage points lower than in the three months to August.

Firms therefore expect their wage growth to decline by 1.6 percentage points over the next 12 months based on three-month averages.

The DMP report also shows a small drop in business uncertainty (despite other surveys showing that confidence has been hit by worries about this month’s budget).

It say:

Uncertainty fell in the three months to September with 48% of firms reporting that the overall level of uncertainty facing their businesses was high or very high, one percentage point lower than in the three months to August

Here’s a chart showing how the pound swooned as the Guardian published our interview with Andrew Bailey online:

UK homebuilders rise after BoE governor hints at faster rate cuts

Andew Bailey’s hint that the Bank of England could be “more aggressive” in cutting interest rates is also moving the London stock market.

Shares in housebuilders are rallying, as traders calculate that lower borrowing costs could lift demand for homes.

Housebuilder Persimmon is the top riser on the FTSE 100 share index, up 3.1%, followed by rival Vistry (+2.3%) and Barratt (+2.2%).

A UK interest rate cut in November now looks almost certain, the City believes.

According to the latest money market pricing, a cut in Bank Rate next month to 4.75% is now a 96.5% chance, leaving only a 3.5% likelihood that the BoE leaves rates on hold at 5% again.

Before Andrew Bailey’s Guardian interview moved the markets, a November cut was around an 88% chance, the markets indicated.

Andrew Bailey’s comments are significant, because a couple of weeks ago he sounded rather more cautious about future interest rate cuts.

On 19 September, when the Bank left rates on hold at 5%, Bailey said “It’s vital that inflation stays low, so we need to be careful not to cut too fast or by too much.”

A week ago, he told the Kent Messenger that he thought the path for interest rates would be “downwards, gradually”.

So, today’s talk about being a bit more “activist” and “aggressive” do feel like a change in stance, which is why the pound dropped this morning.

Breaking News: Sudden fall in #Pound Sterling after Bank of England Governor Andrew Bailey said in an interview with the Guardian newspaper that the central bank could become “a bit more activist” on rate cuts if there was further good news on inflation.

GBPUSD DOWN 0.67%

GBPJPY…— Mohammed_Saif10 (@fx_saif10) October 3, 2024