Bank of England expected to cut interest rates as jobs market weakens

Several economists are predicting the Bank of England could cut interest rates as soon as December, following this morning’s weak jobs report.

And looking further ahead, the money markets are now indicating they expect 65 basis points of BoE rate cuts by the end of next year, up from 55 bps on Monday. That means two quarter-point cuts by December 2026 are fully priced in, with a third now more likely.

Suren Thiru, economics director at ICAEW (the Institute of Chartered Accountants in England and Wales), reckons the odds of a rate cut next month have risen, now that unemployment has jumped to 5% and wage growth has slowed.

“These figures suggest that the UK’s labour market is suffering from pre-Budget jitters, as businesses already weakened by April’s rise in national insurance look to cut recruitment further in anticipation of another difficult Budget.

“This weakening in wage growth is likely to accelerate over the winter as the downward pressure from an ailing economy, significant staffing costs and more job losses increasingly restrains pay awards.

“The jobs market could bear the brunt of Budget tax rises as weaker customer demand, amid a possible income tax hike and increasing costs on business, may mean higher unemployment than the Bank of England currently predicts.

“These underwhelming figures add credence to the more dovish tilt to last week’s policy decision and the current rate at which the labour market is loosening notably increases the chances of a December interest rate cut.”

Richard Carter, head of fixed interest research at Quilter Cheviot, points out that BoE governor Andrew Bailey is the ‘swing voter’ on its Monetary Policy Committee, who could be swayed into creating a majority for a cut:

“An early Christmas present could come in the form of an interest rate cut from the Bank of England following a rise in unemployment and a softening in wage growth. The monetary policy committee had a tight 5-4 split on whether to hold or cut rates at last week’s meeting, with Andrew Bailey’s deciding vote erring on the side of caution.

“Today’s figures from the Office for National Statistics show wage growth pressures, albeit still relatively high, are slowly easing. Annual growth in regular earnings excluding bonuses saw a decline to 4.6% compared to 4.7% last month, and total earnings including bonuses fell to 4.8% compared to 5%. Any further signs of easing in the next labour market print could sway a few more on the committee to cut on the 18th December.

Thomas Pugh, chief economist at audit, tax and consulting firm RSM UK, points out that problems at the Office for National Statistics do make today’s data somewhat unreliable….

“A rise in the unemployment rate to 5.0% in September, the highest level since the pandemic, and a further slowing in private sector pay growth throws the door wide open to a December rate cut – as long as the budget is as deflationary as the Chancellor hinted at last week.

“Overall, the labour market appears to still be weakening with the unemployment rate ticking up and employment falling on both the LFS and payrolls measures. Admittedly, the unemployment rate is being driven up by an erratic looking jump in unemployment on the single month figures. Even though the ONS has made improvements to the Labour Force Survey, which is where the official measures of employment statistics are derived from, it continues to be distorted by a low response rate making it less reliable than in the past.

Key events

Disabled people are bearing the brunt of the weakening UK job market, charity Scope is warning today.

Scope, the disability equality charity, has analysed today’s UK labour market report and spotted that the number of disabled people in employment fell by 349,000 between July-September 2024 and July-September 2025.

This means the Disability Employment Gap (DEG) (comparative employment rates of disabled and non-disabled people) rose to 30.1% points in the third quarter of 2025, up from 27.5% points a year earlier.

They also report that disabled people are more than twice as likely to be unemployed as non-disabled people:

-

Employment rates for disabled people dropped to 52.3% (compared to 54.5% in the third quarter of 2024) while for non-disabled individuals improved, reaching 82.5% compared to 81.9% in the third quarter of 2024.

-

Unemployment among disabled individuals has been rising since the first quarter of 2024. And it continued to do so reaching 9.1% for disabled people in the third quarter of this year (compared to 6.7% same quarter in 2024).

-

Inactivity rates, after stability for few months, began to increase among disabled people from 41.6% in July-September 2024 to 42.5% in same quarter in 2025. This is not the case for non-disabled people, for which inactivity rates have continued to fall.

James Taylor, executive director of strategy at Scope, says:

“It’s alarming that disabled people are bearing the brunt of the weakening job market.

It suggests disabled people are facing a double whammy of being hit hardest by job cuts, and not getting the opportunities they should.

Huge numbers of disabled people want to work but are denied the opportunity, Taylor adds:

“Scope’s employment advisers regularly work with disabled people who have been pushed out of jobs by employers’ negative attitudes or rigid working practices.

“With unemployment rising and hiring sluggish, the government needs to invest in supporting disabled people to get into and stay in work.”

Bank of England policymaker Megan Greene has indicated that this morning’s weak UK unemployment data won’t prompt her to vote for interest rate cuts next month.

Greene is one of the more hawkish members of the Bank’s monetary policy committee, and one of the five who voted to leave rates unchanged last week.

Speaking at a UBS conference in London, Greene said she believed the labour market is past the worst and warned that firms are predicting more hefty wage increases, Bloomberg reports.

Greene explaine:

“If you look at some of the higher frequency data, it suggests that maybe the adjustment in the labor market is mostly behind us now. It’s possible that the worst is behind us, but it’s certainly something I’m looking at.”

She did warn, though, that the rise in the unemployment rate to 5% was a blow for the economy, saying:

“Unemployment does have a five handle on it now, for the first time in a really long time. And that’s not great.”

US small business optimism falls

Over in the US, small business owners have grown more pessimistic about their prospects.

The NFIB Small Business Optimism Index declined 0.6 points in October to 98.2, with small firms reporting falling sales and a struggle to hire workers.

The Uncertainty Index fell 12 points from September to 88, the lowest reading of this year.

NFIB chief economist Bill Dunkelberg says:

“Optimism among small businesses declined slightly in October as owners report lower sales and reduced profits.”

“Additionally, many firms are still navigating a labor shortage and want to hire but are having difficulty doing so, with labor quality being the top issue for Main Street.”

The report found:

-

Thirty-two percent (seasonally adjusted) of all owners reported job openings they could not fill in the current period, unchanged for the second consecutive month. Before August, the last time unfilled job openings hit 32% was in December 2020.

-

In October, 27% of small business owners cited labor quality as their single most important problem, up 9 points from September and the highest level since the record high of 29% in November 2021. Labor quality ranked as the top problem and was 11 points higher than taxes, which ranked second.

-

A net negative 13% of all owners (seasonally adjusted) reported higher nominal sales in the past three months, down 6 points from September.

The prospect of a cut in UK interest rates next month has driven up shares in Britain’s housebuilders.

Berkeley Group (+2%) are among the top risers on the FTSE 100 index this morning, with Persimmon (+1.6%) and Barratt Redrow (+1.6%) both higher.

Chris Beauchamp, chief market analyst at IG, explains:

“The chances of a December rate cut have risen throughout the morning following the unemployment figures, and now stands at 86%. This expectation of looser policy has given a boost to housebuilder shares – Berkeley, Barratt Redrow and Persimmon are all higher this morning, notably head of figures from the latter two this week.

Some of the impact of lower borrowing costs will be offset by the expected tax rise heading our way in the Budget, but further rate cuts also loom on the horizon, particularly if inflation keeps coming down too.”

Over in Germany, investor morale has fallen unexpectedly this month.

The ZEW economic research institute’s economic sentiment index has dropped to 38.5 points from 39.3 points in October, dashing hopes of a rise to 41.

ZEW president Achim Wambach says:

“The overall mood is characterised by a fall in confidence in the capacity of Germany’s economic policy to tackle the pressing issues.”

73% chance of rate cut in December

The odds of a UK interest rate cut next month have risen towards 75% today, after unemployment jumped to 5% and wage growth slowed.

The money markets now indicate there is a 73.6% chance of a rate cut in December, to 3.75%, and just a 26.4% prospect that the Bank of England leaves borrowing costs on hold again, at 4%.

Before this morning’s labour market report, a December cut was seen as a 61.5% chance.

Analysts at Japanese bank Nomura say:

-

Today’s labour market report was weaker than expected, with the unemployment rate rising above consensus expectations to 5.0% in Q3, and private sector regular pay growth soft at 0.2% m-o-m in September.

-

This follows soft labour market data in the previous report. However, policymakers left Bank Rate unchanged at the November MPC meeting last week, citing the need for an accumulation of evidence to support further policy loosening.

-

Today’s data support a December Bank of England (BoE) rate cut, but we acknowledge that there are several more data releases, and also the budget, before then. We think these releases will add to reasoning for another 25bp cut at the next policy meeting.

UK grocery inflation slows as supermarkets ramp up promotions

UK grocery inflation has slowed, in a boost to households.

Grocery price inflation slowed to 4.7% in October, data from Worldpanel by Numerator shows, as consumers bought more on deals.

Just under 30% of grocery spending was on promoted items last month, they say, as consumers cut back ahead of the budget.

Fraser McKevitt, head of retail and consumer insight at Worldpanel, explains:

“Christmas ads are hitting our screens and the race to the big day is on in the supermarket sector. Retailers are very alive to the financial struggles that some households are facing, not least ahead of this year’s Budget.

They’re eager to show how they’re offering shoppers value for money, putting the emphasis on price cuts rather than multibuy offers. It’s not just the Grinch who’s looking for savings with just shy of 30% of consumer spending at the grocers on promoted items in October, a figure that we expect to go even higher as we get closer to Christmas.”

Back in the City, shares in AstraZeneca have hit a fresh record high.

The move cements AstraZeneca’s position as the largest UK-listed stock by market value, with its value now approaching £210bn.

Last week, the company announced stronger-than-expected quarterly earnings.

But there is also doubt over its long-term commitment to the London market, after it decided in September to also list its shares directly on the New York Stock Exchange.

Trump ‘working on’ a trade deal with Switzerland

Lisa O’Carroll

Donald Trump has said he is “working on a deal” to reduce the punitive 39% tariff he slapped on Switzerland in August, with expectations a deal aligning the country with the EU’s 15% could be sealed within the fortnight.

Richemont and Swatch Group shares rose on Tuesday.

Switzerland has been hit with one of the highest tariffs in the world baffling the country’s leaders and industries.

“We’re working on a deal to get their tariffs a little bit lower,” Trump said. “I haven’t set any number, but we’re going to be working on something to help Switzerland,” he added on Monday night.

Shares in the Watches of Switzerland group have rusen by more than 7% in early trading, while Swatch gained 4.2% and Richemont up 2%.

“The talks are ongoing and we do not comment further,” a spokesman for the Swiss Department of Economic Affairs said.

UPDATE: A Swiss source has told Reuters that a deal could come as early as Thursday or Friday this week…

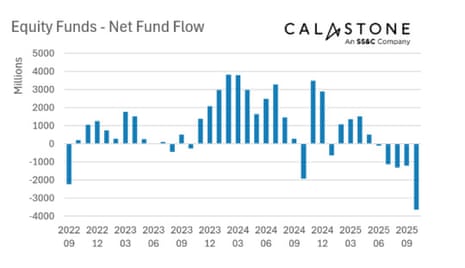

UK investors pull money from global equity funds at record pace

Although the London stock market is at a new peak, we also have new data showing that UK investors have been pulling cash out of global share funds at a record pace.

Global funds network Calastone has reproted that budget concerns and soaring share prices drove record outflows from equity funds in October.

They have found that UK investors pulled £3.63bn out of equity funds in October, the fifth month of selling in a row – the longest stint of selling since the Brexit referendum in 2016.

Since June, they say, £7.36bn has left equity funds, also a record.

Calastone also reports:

-

All equity categories saw net selling; UK funds lost £1.22bn in October alone.

-

Global, North American and technology funds also saw heavy withdrawals.

-

Investors shifted some of the capital to lower-risk assets, with a record £955m into money market funds and £589m into fixed income.

Edward Glyn, head of global markets at Calastone says two forces are driving investor behaviour:

One is simply nerves about global equity prices, especially in the US.

Outflows from global, US and tech funds are all part of that story. Fears of high share prices also explain why money market and fixed income funds both had a good month -cash rolling out of equity funds needs somewhere to go, especially for those who don’t want to lose the tax protection of an ISA or pension wrapper.

“The other force stems from growing concern about Rachel Reeves’s budget and the anticipated tax implications. For some, it’s a simple matter of crystallising capital gains in case rates go up. This drove a huge uptick in selling this time last year and it’s clearly round two in 2026.

“For many others it’s about pensions. The tax-free lump sum that over 55s may draw from their pensions is such a vital part of most people’s retirement planning that the risk it will be scrapped or drastically scaled back is simply too concerning for many diligent pension savers in their 50s and beyond to contemplate.

“Speculation on policy has made this drastic step the only rational choice for many, even if it may ultimately harm their longer-term financial goals.”

Victoria Scholar, head of investment at interactive investor, points out that London’s stock market is outpacing the rest of Europe this morning:

“After hitting a record closing high on Monday, fuelled by mining stocks, the FTSE 100 continues to push higher, gaining another 1% outperforming mainland Europe.

Vodafone is leading the charge, up over 6% after raising its dividend and annual profit forecast. Housebuilders are also trading higher after the latest UK unemployment data fuels hopes of a December rate cut from the Bank of England. Fresnillo is in the green thanks to higher precious metals prices with gold continuing its ascent, rallying close to 3-week highs amid growing expectations that the Fed will cut interest rates next month.

The pan-European Stoxx 600 is up 0.6% this morning, with Germany’s DAX up 0.2%.

Market Report: UK wages pave way for rate cuts, US dip buyers’ cheer

Here’s Matt Britzman, senior equity analyst at Hargreaves Lansdown, to explain why the London stock market has hit a new peak today:

“The FTSE 100 has opened with a spring in its step, as cooling wage growth fuels hopes the Bank of England will cut rates in December. Private sector pay, a key metric for the committee, slowed to 4.2% in September, while broader wages undershot forecasts. Labour market signals are softening across the board, with payrolls falling again in October and unemployment nudging higher. Markets are now pricing in a 73% chance of a December rate cut, as the case for policy easing gains traction.

Vodafone put on a confident face this morning, unveiling a new progressive dividend policy and guiding to the top end of FY26 expectations – the first signal that its self-declared growth phase is gaining traction. With pressure mounting ahead of the print, the return to service revenue growth in Germany marks a meaningful step in turning around its largest market. There’s still work to do, but the combination of upbeat commentary, improving momentum in the UK and Africa, and a stabilising European core should land well with investors. For a name priced for pessimism, today’s update offers a few glimmers of hope.

Dip buyers are sitting pretty with US stocks rebounding yesterday evening, as optimism around a potential US government funding deal helped lift sentiment. Retail favourites like Palantir led the charge, while Nvidia clawed back recent losses, reminding markets why it’s still the poster child of the AI trade. The fundamentals behind the AI trade remain compelling – momentum may not be linear, but demand signals are hard to ignore. With earnings season winding down, all eyes now turn to Nvidia’s results next week, the final heavyweight test before year-end.