Introduction: UK wage growth falls to four-year low

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

There’s an autumnal chill settling on the UK economy, as businesses and consumers nervously anticipate Rachel Reeves’s November budget.

Salaries almost stagnated last month, new data shows, as companies reported weaker demand for workers and reduced hiring budgets.

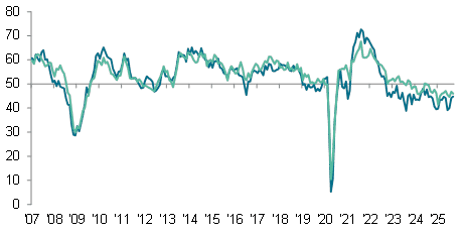

According to the latest KPMG and REC, UK Report on Jobs, starting pay for permanent workers rose “negligibly” in September, with wages rising at the weakest pace since the current run of pay inflation began just over four-and-a-half years ago.

That will fuel concerns that the increase in employers’ national insurance contribution rates have hammered hiring in sectors such as retail and hospitality.

The wage slowdown is clearly bad news for workers, but something which might reassure UK central bankers as they try to bring inflation, and inflation expectations, down.

Neil Carberry, chief executive of REC, says:

“Pay trends remain subdued where pay is set by the market rather than the Government. This suggests that pay growth should not be a drag on the Bank of England’s upcoming interest rate decision.”

The report also found that vacancy numbers across the UK continued to fall markedly at the end of the third quarter. And while demand for staff is falling, the number of candidates looking for a job is rising “rapidly”, it says.

Carberry explains:

“Recruiters have been reporting a trend towards stabilisation in the permanent job market since the summer, and today’s data back that up for September. The temporary market remains somewhat healthier, with growth in some regions.

We can hope that the jobs market and the economy may be moving towards calmer waters, but falling vacancies is a reminder that what is really needed is a shot of confidence in the wider economy to get things going.

The agenda

Key events

Shares in US gas supplier Venture Global are set to tumble later today, after it lost an arbitration case broughy by BP.

BP had accused Venture of breaching contracts, by not making liquefied natural gas (LNG) deliveries under long-term supply contracts once prices jumped after Russia’s invasion of Ukraine.

Venture, BP claimed, had instead sold that LNG for higher prices on the spot market.

The UK oil group is reportedly seeking damages in excess of $1bn, as well as interest, costs and attorneys’ fees. Shares in Venture are down 14% in pre-market trading.

Brickmaker Ibstock reports weaker demand

Building materials maker Ibstock has warned that demand in the construction sector has weakened, as customers grew less confident.

Ibstock, which makes bricks and concrete, has told the City this morning that demand in its core construction markets has been weaker than expected, due to “a more uncertain near term economic and political backdrop”.

Joe Hudson, CEO of Ibstock, told shareholders:

“With clear, long term structural imperatives for residential construction growth, it is disappointing that additional near term headwinds are impacting momentum in our markets in the latter part of the year. In spite of this difficult and uncertain market backdrop, the Group has continued to make good operational progress and maintain share.

“Whilst it remains difficult to predict the pace and timing of market recovery, we will continue to focus on strong execution and progressing our long term strategic growth projects. These initiatives, combined with the increasing contribution from our recent investments, leave us well positioned to benefit as the market returns.”

Shares in Ibstock have dropped almost 10% this morning, making it the top faller on the FTSE 250 index of medium-sized companies.

There’s a calm start to trading in London, where the FTSE 100 share index has dipped by 13 points, or -0.14%, to 9496 points.

Mining stocks are leading the fallers, with Endeavour Mining (-4.3%) and Fresnillo (-3.5%) hit by a drop in the gold price, back below $4,000 per ounce, after a series of record highs.

But advertising group WPP (+2.2%) and catering firm Compass (+2%) are leading the risers.

Richard Hunter, head of markets at interactive investor, says there are “some pockets of profit taking” in the markets, as the ongoing US government shutdown reprives investors of some economic news.

UK retail footfall drops

Visits to UK retailers also fell last month, a sign that consumers are more nervous about spending.

Total UK footfall at retailers decreased by 1.8% in September, on an annual basis, worse than the 0.4% drop recorded in August, according to the British Retail Consortium (BRC).

BRC-Sensormatic data found:

-

High Street footfall decreased by 2.5% in September (YoY), down from +1.1% in August.

-

Retail Park footfall decreased by 0.8% in September (YoY), up from -1.1% in August.

-

Shopping Centre footfall decreased by 2.0% in September (YoY), down from 0.0% in August.

Customers “put the brakes on non-essential spending”, according to the BRC. Their CEO, Helen Dickinson, says:

This was due largely to declines in Non-food sales, as fashion and full price big-ticket items were held back by lower consumer confidence. Gaming bucked the trend, thanks to some popular new releases. Food sales remained solid as the month saw the conclusion of football tournaments and two bank holidays, prompting spending on BBQs and picnics.

The pound dropped to a two-month low against the US dollar last night, with investors showing sterling little love.

The UK currency dipped below $1.33 for the first time since 6 August. This morning it’s trading around $1.329.

It’s also slightly lower against the euro, at €1.149.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, says:

Sterling remains very much unloved heading into the Autumn Budget.

Even though French political shenanigans have capped the upside in the EURGBP since late September, the outlook remains more supportive for continental Europe than for the UK, where sluggish growth, persistent fiscal pressures and a hesitant Bank of England continue to weigh on sentiment.

New results from recruitment firm Hays underline how the jobs market has weakened.

Hays has reported that the fees it earns for placing candidates into jobs fell by 9% in the United Kingdom & Ireland in the third quarter of this year, and by 8% globally.

The company, which has cut its consultant headcount by 15% over the last year, also reported that fees from filling permanent positions, worldwide, is down 13%.

And looking ahead, Hays warns that it sees little improvement soon, telling the City:

Given ongoing macroeconomic uncertainty, we expect near term market conditions to remain challenging and, although we have limited forward visibility, we believe this is likely to persist through FY26.

Permanent placements decline again

Today’s KPMG and REC UK Report on Jobs survey also shows that the number of permanent placements fell again in September, but at the slowest rate in a year.

The report shows that firms often noted that employers were hesitant to take on new workers due to weaker economic conditions and cost concerns.

Jon Holt, group chief executive and UK senior partner at KPMG, says:

“With very little positive news out there on the economy in recent months, and lots of speculation about the Budget, it is understandable that employers are cautious with their hiring. But despite these headwinds, our annual CEO Outlook revealed this week that chief executives are more upbeat about future growth prospects for their industry and the UK economy than might be expected. They are resilient and responding to challenges by adapting their investment strategies to focus on AI adoption, managing cyber risk and upskilling their talent.

“The jobs market has not yet turned a corner and remains tough, but we saw stabilisation in some of the numbers last month. While the public finances provide little room for manoeuvre in November, some clear signals from the Chancellor that build on business confidence will hopefully support renewed hiring as we head into 2026.”

Introduction: UK wage growth falls to four-year low

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

There’s an autumnal chill settling on the UK economy, as businesses and consumers nervously anticipate Rachel Reeves’s November budget.

Salaries almost stagnated last month, new data shows, as companies reported weaker demand for workers and reduced hiring budgets.

According to the latest KPMG and REC, UK Report on Jobs, starting pay for permanent workers rose “negligibly” in September, with wages rising at the weakest pace since the current run of pay inflation began just over four-and-a-half years ago.

That will fuel concerns that the increase in employers’ national insurance contribution rates have hammered hiring in sectors such as retail and hospitality.

The wage slowdown is clearly bad news for workers, but something which might reassure UK central bankers as they try to bring inflation, and inflation expectations, down.

Neil Carberry, chief executive of REC, says:

“Pay trends remain subdued where pay is set by the market rather than the Government. This suggests that pay growth should not be a drag on the Bank of England’s upcoming interest rate decision.”

The report also found that vacancy numbers across the UK continued to fall markedly at the end of the third quarter. And while demand for staff is falling, the number of candidates looking for a job is rising “rapidly”, it says.

Carberry explains:

“Recruiters have been reporting a trend towards stabilisation in the permanent job market since the summer, and today’s data back that up for September. The temporary market remains somewhat healthier, with growth in some regions.

We can hope that the jobs market and the economy may be moving towards calmer waters, but falling vacancies is a reminder that what is really needed is a shot of confidence in the wider economy to get things going.