UK consumer confidence falls as households worry about debt

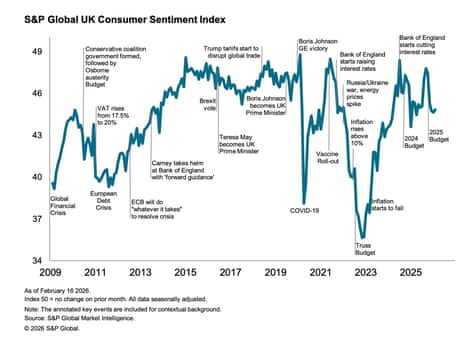

UK consumer sentiment continued to sink this month, as households grow more worried about debt levels.

A poll of consumer confidence from data firm S&P Global has found that morale continued to drop in February, although not as quickly as in January.

The report shows:

-

Consumers signal stronger rise in debt alongside a quicker deterioration in loan availability

-

Appetite for major spending recedes to weakest in ten months

-

Sentiment regarding labour market conditions at lowest since last June

This left the S&P Global UK Consumer Sentiment Index (CSI) at 44.8 in February, up from 44.6 in January, but still below the 50-point mark that shows no change compared with the prior month.

Maryam Baluch, economist at S&P Global Market Intelligence, said:

“The mood among UK households matches the dismal weather seen so far this year across the country. Although the overall degree of gloom has lifted slightly since January, consumer confidence continues to run at one of the lowest levels seen over the past two years.

A period of prolonged rain and a dearth of sunshine have no doubt not helped to lift the low spirits seen among households, but there’s more going on here than just bad weather. Households are growing increasingly worried about debt in particular, especially as a rising need for credit was met with the steepest decline in availability of loans since August 2024.

Households’ appetite for major purchases was impacted by the lack of confidence and debt worries, with sentiment around big ticket expenditure slipping to the lowest in ten months. The low appetite to spend bodes ill for the broader impetus to purchase, hinting at a sustained drag on economic growth from sluggish consumer spending in the first quarter.”

Key events

UK consumers’ sentiment about debt has hit its lowest level in 23 months, today’s report shows.

S&P Global explains:

UK households indicated a further increase in debt in February, with the rate of accumulation the strongest recorded since last July.

Debt levels rose across all age groups except those aged 25–34, where debt stabilised, with the steepest rate of increase among 18–24 year olds. Households also expressed a stronger need for unsecured credit in the latest survey period, but the accessibility of loans continued to deteriorate.

Notably, households signalled that the availability of unsecured credit declined at the steepest pace in a year-and-a-half.

S&P Global also report that households across all 12 UK regions and nations registered a decline in their current financial health this month.

The steepest reduction was recorded in the East Midlands, while the softest was in London.

Today’s consumer sentiment report explains:

Although sentiment around current finances was less downbeat, households were slightly more pessimistic regarding their financial prospects for the coming next 12 months.

The respective seasonally adjusted index dipped to a two-month low, with only households in London, the West Midlands and the North West forecasting an improvement in their financial health over the next year.

UK consumer confidence falls as households worry about debt

UK consumer sentiment continued to sink this month, as households grow more worried about debt levels.

A poll of consumer confidence from data firm S&P Global has found that morale continued to drop in February, although not as quickly as in January.

The report shows:

-

Consumers signal stronger rise in debt alongside a quicker deterioration in loan availability

-

Appetite for major spending recedes to weakest in ten months

-

Sentiment regarding labour market conditions at lowest since last June

This left the S&P Global UK Consumer Sentiment Index (CSI) at 44.8 in February, up from 44.6 in January, but still below the 50-point mark that shows no change compared with the prior month.

Maryam Baluch, economist at S&P Global Market Intelligence, said:

“The mood among UK households matches the dismal weather seen so far this year across the country. Although the overall degree of gloom has lifted slightly since January, consumer confidence continues to run at one of the lowest levels seen over the past two years.

A period of prolonged rain and a dearth of sunshine have no doubt not helped to lift the low spirits seen among households, but there’s more going on here than just bad weather. Households are growing increasingly worried about debt in particular, especially as a rising need for credit was met with the steepest decline in availability of loans since August 2024.

Households’ appetite for major purchases was impacted by the lack of confidence and debt worries, with sentiment around big ticket expenditure slipping to the lowest in ten months. The low appetite to spend bodes ill for the broader impetus to purchase, hinting at a sustained drag on economic growth from sluggish consumer spending in the first quarter.”

An alarming stock market statement from skin health company SkinBioTherapeutics has knocked its share price by over 40% today, adding to a 50% tumble on Friday.

SkinBioTherapeutics told investors that its Board has been “urgently conducting an investigation of the business” since its CEO, Stuart Ashman, resigned on Friday having been suspended ahead of “an investigation into matters relating to his conduct”.

Information received late last Friday has “cast significant doubt on the validity of the accrued royalty income” recorded in last year’s financial results.

Those payments, which amounted to £770,000, are expected to now be removed from the company’s accounts.

SkinBioTherapeutics says:

In addition to the initial concerns around his conduct, in light of the newly available information, the Board has reason to believe that the former CEO has misrepresented material information to the Board and senior management, the Company’s auditors and advisors.

It also warns that the results for the current financial year (ending 30 June 2026) are expected to be significantly below current market expectations.

Defence stocks rise on reports UK considering ‘significant increase’ to spending

Shares in UK defence companies are rising this morning, following a report that the British govermment could bring forward its target to spend more on defending the country.

The BBC reported that the British government is considering bringing forward the date by which it will spend 3% of economic output on defence, to the end of the current parliament. Previously, it has pledged to raise defence spending to 2.5% of GDP by 2027 and targeted 3% in the next parliament.

Engineering firm Babcock, which supports naval, land, air and nuclear operations – including the UK’s nuclear submarine fleet – have risen by 2.5%.

Aerospace parts supplier Melrose are up 2.2%, while BAE Systems has risen 1.3%.

On Saturday, Keir Starmer told the Munich Security Conference that the UK and Europe need to step up their commitments to Nato and avoid the risk of overdependence on the US for defence.

Yen falls after GDP report

Japan’s currency has weakened following today’s GDP report showing weaker-than-expected growth at the end of last year.

Lee Hardman, currency expert at MUFG bank, explains:

After hitting a low of 152.27 at the end of last week, USD/JPY has risen back above the 153.00-level. The main trigger for the partial reversal of yen strength has been the release of the weaker than expected Q4 GDP report from Japan.

The report revealed that Japan’s economy expanded by an annualized rate of just 0.2% in Q4 following a downwardly revised contraction of -2.6% in Q3.

For the calendar year as a whole, Japan’s economy expanded by 1.1% after contracting marginally by -0.2% in 2024. It was the strongest calendar year of growth since 2022. Still, the loss of growth momentum in the second half

Pinewood shares toppled after Apax walks away from takeover talks

On the London stock market, there’s a cautious start to the new trading week… although shares in automotive technology firm Pinewood.AI have tumbled by almost a third.

Pinewood, which provides software management systems to car dealers, fell 30% in early trading after investment group Apax Partners walked away from takeover talks, due to. “prevailing challenging market conditions”.

Pinewood told the City this morning that it is well-positioned to continue executing its strategy, saying:

The Board of Pinewood.AI remains very confident in the positive long-term prospects for the Group. The Company occupies a leading position as a mission-critical, full-service, embedded technology provider to automotive retailers and OEMs, benefitting from high recurring revenues and long-standing OEM partnerships.

This platform positions Pinewood.AI to remain at the forefront of technology innovation and provide best in class technology and secure solutions across its existing and future customers.

Switzerland returns to growth

Newsflash: Switzerland has also escaped recession, despite the economic damage caused by US tariffs.

Swiss GDP expanded by 0.2% in the fourth quarter of 2025, a new estimate shows. That follows a 0.5% contraction in the third quarter of 2025, when the US trade war hurt its exporters.

Switzerland’s State Secretariat for Economic Affairs says that “growth in the services sector was muted, while the industrial sector stagnated,” in Q4, adding:

According to provisional results, the Swiss economy grew by 1.4% in 2025 overall, following 1.2% the previous year.

This is well below Switzerland’s average economic growth (1.8% since 1981). The challenging international environment slowed the export‑oriented industry.

By contrast, the services sector grew at an above‑average rate by historical standards

President Trump hit Switzerland with 39% tariffs under his trade war, before agreeing to lower them to 15% in November.

Japan has slotted in at the bottom of the G7 growth table, along with the UK:

With Canada and the US yet to report their GDP data for October-December, here’s what we know so far:

Competition among UK house sellers at 11-year high

Competition among UK house sellers is running at an eleven-year high, giving buyers more opportunities and keeping prices pegged this month.

Property portal Rightmove is reporting this morning that the average asking price for a newly listed homes dipped by just £12 this month, to £368,019.

And with more houses on the marker – after a record number of early-bird new sellers coming to market sinceBoxing Day and in January – potential buyers have plenty of choice.

Rightmove says the high number of homes for sale is continuing to benefit buyers, giving them more choice and more power to negotiate.

And with last November’s budget behind us, net confidence among buyers and sellers in January has risen back to its highest level since September 2025, Rightmove reports.

Should the Bank of England cut interest rates at its next meeting, in March, that could give borrowers another lift, as the peak spring selling season approaches.

According to Rightmove, the average asking price is the same as a year ago, after that £12 shuffle lower.

That’s despite a record asking price increase for the time of year in January, which means prices are up by 2.8% since December

As the market is “still very price-sensitive,” sellers need to pitch their properties realistically, says Colleen Babcock, property expert at Rightmove:

“Virtually flat prices in February really needs to be viewed alongside what happened in January.

After the prolonged uncertainty in the run up to the late November Budget, plus the usual Christmas slowdown, we saw activity pick up again from Boxing Day. Many sellers, some of whom had been holding back because of the Budget, came to market in early 2026 with renewed confidence, which helped to drive that bumper January price rise.

But the market fundamentals haven’t changed. There are still lots of homes for sale, and buying activity isn’t as strong as this time last year, when many buyers were rushing to move before the stamp duty increase in England. So in February, sellers have taken a more cautious approach by holding onto January’s gains rather than pushing prices higher, at a time when competition is high and the market is still very price-sensitive.”

After a bullish January, sellers overall think better of asking for more as increased competition stifles growths. Annually prices remained flat but many sellers tiptoed higher in February hoping end of year budget restraints being now removed would release pent up demand.… pic.twitter.com/PQbemcjmJN

— Emma Fildes (@emmafildes) February 16, 2026

Japan’s stock market dips

Shares fell in Tokyo as investors digest today’s weaker-than-expected growth report.

The Nikkei 225 index dipped by 0.24%, while the broader Topix shed 0.8%.

Masahiro Ichikawa, chief market strategist at Sumitomo Mitsui DS Asset Management, said:

“I figured the GDP figures would be treated as past figures, but seeing the Nikkei average struggling to gain, there may be some slight impact.”

Introduction: Japan avoids recession with weak return to growth

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Japan has escaped falling into recession, just, with a weak return to growth that highlights the need for punchy measures from its new government to spur the economy on.

Japanese GDP expanded by just 0.1% in October-December, fresh data from Japan’s Cabinet Office shows, missing forecasts of 0.4% growth.

That follows a contraction of 0.7% in July-September, and means Japan has avoided a technical recession – two negative quarters of growth in a row.

Private consumption drove the expansion, while exports and public spending were weak.

Shinichiro Kobayashi, chief economist at Mitsubishi UFJ Research and Consulting, explained:

“Personal consumption showed resilience, but whether this resilience can be sustained will depend on whether price relief measures will make an impact and whether real wages will turn positive.”

Japan’s economy has been hurt by Donald Trump’s trade war, which increased tariffs on Japanese goods entering the US.

The diplomatic row between Beijing and Tokyo over the security of Taiwan also weighed on the economy, with Chinese tourism to Japan almost halving.

The data comes just a week after prime minister Sanae Takaichi won a landslide election victory, having promised “responsible and proactive fiscal policies”.

Takaichi was due to meet with Bank of Japan governor Kazuo Ueda, in their first bilateral meeting since the election.

Last November, Takaichi unveiled a massive ¥21.3tn (£100bn) stimulus package in an effort to spur economic growth and protect households from the rising cost of living. Further measures may be needed….